Why Use a Real Estate Commission Advance? To Help Grow and Maintain Your Real Estate Business.

“In the real estate business there are peaks and troughs of cash flow. If you are in a trough, you may need to realize fees in advance of the closing.”

– Joseph Genovesi, CEO, Accel Real Estate Commission Advance

Introduction – Why Use a Real Estate Commission Advance

The main reason to use a real estate commission advance is to get your money in your bank account as soon as you possibly can. For Real Estate Agents, as with any business, waiting on your money is usually a recipe for lost opportunity.

Plus, as interest rates continue rising, home sales are slowing, which means the days of listing a home in the morning and selling it that afternoon might be gone and not be seen again for many years. You might have to wait months or even a year before a listing sells depending how high “the fed” raises interest rates to tamp down inflation.

This means that as a realtor, you are going to be laying out money for marketing, repairs, staging, and more and have to wait awhile before you sell a home, and then wait longer to finally collect your commission. But if you use a real estate commission advance, you can at least shorten the time it takes to get some of your money between a purchase agreement being made and closing.

What is a Real Estate Commission Advance?

A real estate commission advance is a financial service that allows real estate agents to sell a portion of their pending commission for a fee. They receive some of their money now which they can use to finance operations, conduct marketing, pay vendors, or find their next fix and flip. Waiting on money is lost time, and lost time is lost money. A real estate commission advance helps get some of your money in the bank now, so you can keep growing (or so you can pay your bills).

How Does a Real Estate Commission Advance Work

When you are owed a real estate commission (due at closing), it is considered an asset, and like any other asset, you can sell that asset to a third-party buyer at an agreed upon price. This is precisely how a real estate commission advance works. The money you are owed from a pending closing is an asset, and you can sell that asset to a third party at a discounted rate. The benefit to you is, you get some of your money right away. The benefit to the Real Estate Commission Advance Company is they get their fee.

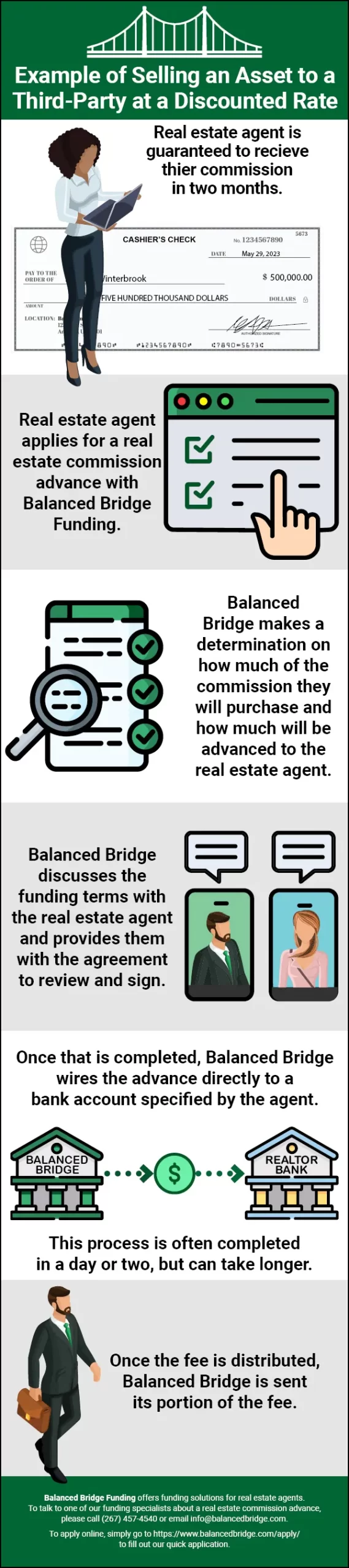

Example of Selling an Asset to a Third Party at a Discounted Rate Infographic*

- A real estate agent is guaranteed to receive a commission but will experience some delay before their commission is distributed to them.

- The real estate agent applies for a real estate commission advance with Balanced Bridge Funding.

- Balanced Bridge makes a determination on how much of the commission they will purchase and how much will be advanced to the real estate agent

- Balanced Bridge discusses the funding terms with the real estate agent and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the real estate agent

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Why Realtors Use Commission Advances – Cash Flow

The Basic Cash Flow Problem for Realtors

It is expensive to sell a home for a client. You have to pay for yard signs, MLS Listings, Staging Expenses, repairs your clients can’t afford themselves, open houses, gas, and more. And while you are laying out money for all these things, until a home sells, your savings account balance keeps declining until you get paid at closing.

This is the basic cash flow problem for realtors – lots of money going out of your bank account (or onto your credit cards) to cover the cost of selling the home, and no money coming in until closing which can be anywhere from thirty days to six months.

But you are not alone. Most businesses experience similar cash flow struggles. Any time you have money going out immediately and no money coming in until later, you are going to have a cash flow issue. So, let’s talk a little bit more about cash flow in general. It will help you understand the problem clearly, and it will also make you a better businessperson.

People in business often talk about cash flow, but few of them truly understand what it means. Cash flow is the term used to describe the “flow of cash” into your bank account versus the “flow of cash” out of your bank account. So, when people talk about cash flow, all they are talking about is “money flowing in and money flowing out.”

When your money is flowing out quickly and flowing in slowly, you tend to have “cash flow problems.” Why? Because the money is “flowing out” faster than it is “flowing in” and if this continues to happen long enough you will run out of cash to pay your bills. When you can’t pay your bills, you are out of the game. It doesn’t matter if you have a large sum of money guaranteed to you some time in the future; when you don’t have any of it in the bank, your creditors don’t care – they want their money now and you can’t pay them. This is the basic cash flow problem – money flowing out faster than it flow in, or at irregular intervals.

What is Cash Flow management? – Cash flow management is any activity used to regulate these two flows of cash (cash flowing in versus cash flowing out). The goal of cash flow management activities is to keep the money flowing into the account faster than it leaves.

When most people think about cash flow management, they tend to imagine cost cutting – reducing spending and keep costs down. But the truth is, most serious businesses do not focus a lot on cost cutting. Instead, they tend to focus on keeping cash coming in frequently and as quickly as they can get it. They may do this by borrowing money, selling bonds, selling stock (equity), factoring the money they are owed (selling it early as a discount), and trying to drive up revenues through sales activity.

Very few people are going to “reduce” their way to success. You need coming in frequently, whether that is from sales, or from taking out loans. Either way, you must have enough cash available to you to pay your regular monthly expenses or you are out of business.

What Causes Cash Flow Problems for Realtors? – Cash flow problems for realtors are caused by the “timing” of when they get paid (money flowing into their bank account) versus the timing of when that money gets spent (money flowing out of the bank account).

Understanding the Timing Problem – When you close a deal on a house, you must wait to be paid at closing. This is the cause of the “timing problem.” It doesn’t matter that you have money coming in “soon,” you still have to pay bills, make payroll, pay for marketing, etc. So, you have money going out constantly, but you only have money coming in “occasionally.”

Because you get paid at irregular intervals as a realtor, but you spend your money at regular intervals on bills and living expenses, you have a situation where the “timing” of money coming do not match the “timing” of money going out, which creates cash flow problems.

This isn’t a problem that is unique to the real estate industry; most businesses have this kind of cash flow challenge. Lawyers who work on a contingency fee basis may work for years on a case, incurring massive expenses along the way, conclude the case, and then have to wait for the defendant to pay them. Hospitals have to provide services first and bill for those services later. They often have to wait over sixty days to receive cash for services they performed. Just about every type of business has cash flow struggles created by money going out constantly, and money coming in occasionally.

To solve their cash flow challenges, Realtors need to find ways to “finance the gap” between reaching an agreement on a house and getting paid at closing.

One way to do that is to take out a real estate commission advance instead of waiting for closing to receive your funds at some point in the future. You can’t do anything with “money you are owed.” You have to get the money into your bank account to make it work for you. A real estate commission advance is one way to do it.

Financing “the gap” to Solve the Cash Flow Problem for Realtors

Financing “The Gap” using Credit Cards

Many real estate agents are financing their cash flow with credit cards. This is particularly true of newer real estate agents. Basically, they are putting all of their expenses on high interest credit cards while they wait to close a deal on a listing. Then, once they get their commission, they (hopefully) pay down their credit cards.

There are some challenges with this approach. The main one is, credit cards can limit the growth of your business by simply not granting you enough credit. Let’s face it – are you going to take on more listings as a realtor when you know your credit cards are just about maxed out? Probably not. You’ll have to skip some opportunities until you either get a credit increase or get those cards paid down with your next commission. This will forever limit your growth.

Credit Score – credit cards are dependent upon your credit score. And the higher your balance is on your current credit cards, the less likely you are to get a credit increase or qualify for an additional credit card.

Interest Rates – Interest rates are incredibly high on credit cards, eroding your long term buying power.

Closed Account – most people who are new to credit cards don’t know this, but credit card companies change their lending standards regularly without telling people. And when this happens, as soon as you pay off a credit card, they close your account. That’s right. One day you pay off your credit card just like you always do, and they simply close the account (without telling you). This happens every day. This has a two-fold impact. One, you lose access to that credit line for funding operations. Two, it throws off your debt to equity ratio, and almost always causes your credit score to decline, limiting your ability to get a new credit card, or if you can get a new card, it increases your interest rate, and possibly annual fees.

So, financing your entire real estate business operations only on credit cards can have some issues. We aren’t saying you shouldn’t have business credit cards. In fact, you should use every financing option available to you as a realtor. Just know the strengths and weaknesses of each financing option so you can make the best choices for your business.

Using Business Lines of Credit and Business Loans for Cash Flow Management

A line of credit is basically an “open” or “revolving” loan from a bank of financial institution that allows you access to cash when you need it. Unfortunately, as a realtor, you may find that trying to secure a business loan or a line of credit is not that easy to do; especially during your early years as a real estate agent. Banks often require applicants to present non-liquid assets, such as bonds, stocks, and real estate as collateral to guarantee they get their money back. If you don’t pay, they can at least sell your assets to offset their losses.

If you perform a search on the internet for “business line of credit for realtors” you might notice that banks do not show up on the first page of Google. No financial institution shows up at all on the first page of search results. Most of what you see are articles about how hard it is to get a business line of credit or, advertisements for private equity firms offering capital loans. This tells us that banking institutions may not be that interested in marketing a business line of credit to real estate agents as an important part of their business strategy. If they did, those banks would show up on the first page of search results, but they don’t. In fact, you won’t find traditional banks listed hardly anywhere on the internet if you are looking for a business line of credit as a real estate agent.

Does this mean you cannot receive a line of credit from a traditional lending institution? Not at all. Over time as your business grows, establishes a history of revenues, develops a strong balance sheet, and has assets to use for collateral, you will find it easier to obtain financing (including a business line of credit) from banks and other lending institutions. But until then, it is not going to be easy to get a line of credit.

What Is the Difference Between a Realtor Commission Advance and a Bank Loan?

A realtor commission advance does not really resemble a bank loan at all. Real Estate Commission Advances are not repaid in installments, your credit is not a primary factor in receiving an advance, and the fee structure is much different. Also, a real estate commission advance does not accrue daily, monthly, and yearly interest like a bank loan.

Credit Checks Are Not Necessary for Real Estate Commission Advances

There are a few things that could stand in the way of a real estate agent getting approved for a bank loan or line of credit, one of which is their credit score. If an agent has only recently started working at a new agency, declared bankruptcy within the past couple years, or have high balances on their credit cards relative to their credit limit (known as “credit utilization”), they likely won’t meet the criteria set by banks.

For Real Estate commission advance companies, your credit score is not the primary thing they take into consideration when underwriting. Although they do assess for liens and judgments to confirm their ability to collect payment at closing, your credit score will not making a huge impact on their decision.

Realtors Need Options When It Comes to Financing Operations

Having only one vehicle to handle cash flow is sub-optimal. A loan or line of credit may be ideal for one portion of your organization but terrible for the next. Credit, private equity, equity, bonds, futures trading, and factoring are all used by large enterprises to finance operations and growth. Only a few firms can operate solely on their cash reserves.

Real Estate Commission Advances are Fast and Flexible

When you’re looking at your business financing alternatives, keep in mind speed, agility, and adaptability. When you need to raise a significant amount of money quickly to get in on a good deal you just learned about, most loans and lines of credit are going to be hard to get in time.

Precise standards and a lengthy check process are two reasons why banks aren’t known for being fast. Another reason is that their business model generally doesn’t revolve around speed, agility, or creativity. Lending standards have to be stringent in order to protect the bank from making “bad loans.” Thus, the care taken leads to a slower overall process.

However, with a real estate commission advance, you may frequently obtain cash the next day. Real estate commission advance firms have different lending criteria than traditional banks. As a result, our business is extremely nimble.

Plus, using a real estate commission advance is very flexible. You can take out a real estate commission advance when you need it and use other financing vehicles when you don’t.

Real Estate Commission Advances Do Not (usually) Require Additional Collateral

Another advantage of a real estate commission advance is that it does not require you to pledge collateral other than the commissions themselves. You are securing the transaction by using your future commissions, not your liquid assets, which frees up those resources for longer-term financing endeavors.

Pledging an asset as collateral for a loan, results in a Lien being filed against the property, notifying everyone that should the borrower default on their payments, someone else has first rights to the asset. This means that you can’t use one piece of collateral for two separate loans unless you come up with new collateral. However, with a real estate commission advance, the commission itself becomes the collateral so no additional assets are needed (in most cases).

Debt to Equity – The More You Borrow, The Less You Can Borrow in The Future

Another challenge with traditional lending institutions is that the more money you borrow, the less the banks are willing to loan you in the future. If a bank looks at your outstanding debts and sees you already have a lot of loans taken out, they will be less likely to loan you more money. They know the more debt you have, the harder it is to keep up with your payments. And until you get some of your debt paid down, they may refuse to loan you more money, even if you are asking for the money because your company is growing.

But when you take out a Realtor Commission Advance, it does not show up on your credit report, which helps you maintain a healthy debt to equity ratio.

When Realtors Should Use a Real Estate Commission Advance

Realtors could start taking advantage of real estate commission advances right away to finance expansion, hire new talent, increase their marketing budget, and cover their expenses. Big businesses never hesitate to finance their future growth; why should small business be any different? Business owners who think small tend to stay small. If you want to really grow your business, you are going to need third party financing so you might as well get started using it so you can become more comfortable with it.

How to Finance Your Real Estate Business

If you search the internet for “how to finance your real estate business,” most of the articles you will find suggest using your savings, personal credit cards, taking out a second mortgage on your home, borrowing money from your friends or parents, or selling valuable personal items. This is what realtors are being told to do to operate and finance their success. But you don’t ever see bigger businesses operating that way. Not only that, but you won’t go from being a solo entrepreneur to being a successful company this way.

Instead of selling your possessions or draining your parents bank account – start using third party financing companies to finance your growth. Using commission advances for realtors to help manage your cash flow as an example. Get started right away so you get in the practice of financing operations with third party funding companies instead of your own personal assets.

Marketing For Real Estate Agents – Leveraging Third Party Financing

How much should realtors spend on marketing?

If you search the internet for “how much should realtors spend on marketing,” a common number you will see repeated is 8% to 10% of total sales. This isn’t unusual – lots of industry guru’s throw out this number, and not just in real estate; lots of industry “insiders” tell people to spend between 8% and 10% on their marketing as if this is some sort of magic number.

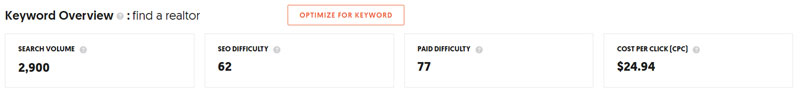

To know how much a realtor should spend on marketing you have to think a little harder. According to research we conducted on spyfu.com – there are real estate companies who are spending over $200,000 (PER MONTH) just on pay per click ads. See Below

Research we compiled from Ubersuggest indicates that for some keywords such as “find a realtor” there are companies are paying up to $26 (PER CLICK) for those keywords in their local area.

It’s going to be difficult to succeed competing with other companies for those keywords trying to contain your marketing budget to just 10% of your sales – especially if you are an up-and-coming real estate agent.

You shouldn’t be using a flat number to make decisions about marketing spend. Instead, you should be asking yourself questions like:

- What are my short-term goals?

- What are my long-term goals?

- How much money do I need to spend to reach those goals?

- Where am I going to get that money from?

Your marketing spend should be determined by the answers to these questions. That is how you know how much you need to spend on marketing. And it doesn’t matter if you don’t currently have the money. You might have to borrow the money, seek out private equity, or take out loans to get the marketing dollars you require to reach your goal.

As long as your marketing spend is determined by the amount of money you currently have in the bank, rather than your goals, the further away your goals are going to stay. This is another good reason when you are wondering why use a real estate commission advance?

Financing Your Marketing as a Realtor

In real estate, as in any business, lost time is lost money. To be successful, it is important to keep your money “flipping.” Waiting for your money is “dead time” you can’t get back. That “lost time” ends up lengthening the time it takes you to become successful. If your marketing is effective, you’re in a better position to take out a real estate commission advance and receive that money immediately. With the new influx of cash, you can then spend it on marketing so that new projects and customers keep coming in.

In an interview about spending money on marketing, Gary Vee (Vaynerchuk) said something like this: “Every month I saw the bill come in from Google and it was like, eighty thousand dollars per month. And I thought to myself I should try to keep that expense down. I was wrong. So wrong. I should have been figuring out how to get that number up to three million dollars per month. And If I had done that, my company could have been where it is now, three years ago. But I only looked at the expense, not the goal of my marketing.”

So, as you are thinking about spending money on your marketing, as long as your marketing is working, meaning you are getting a great return on ad spend, what difference does it make if a real estate commission advance costs you ten percent if your return on marketing is 20% or 30%? If your marketing is effective, you shouldn’t be trying to reduce costs, you should be figuring out how you can borrow as much money as you can to do more marketing.

Myths About Using Real Estate Commission Advances

The general idea that only those realtors who can’t seem to manage their money strategically would need a real estate commission advance is nothing but a myth. The thought process behind this claim being that if you’re doing well enough, you should be utilizing your own funds to finance growth opportunities. However, the reality is that no successful business operates in this manner.

Big businesses never hesitate to use “other people’s money” to finance their growth while keeping their own money in their checking account. Why should you be any different?

The fact is, a business owner should never aim to be debt-free or finance his or her own development with personal funds reserves. Anyone who has even the most basic understanding of company finances understands that if you come across a firm that only uses cash to fund growth and operations, it’s “asleep at the wheel.”

How do you know this? Because if a business is recruiting top talent, utilizing cutting-edge technology, marketing aggressively, and frequently discovering new deals to pursue, they would not be able to finance all of it with their own money. Their cash flows wouldn’t allow it. If you see a company that is debt-free, you can be certain that they are losing ground to someone else who is financing their expansion with “other people’s money,” which means their balance sheet will show debt.

You are, by design, restricting your development and slowing it down when you attempt to rely on your own resources to finance it. Not only that, but you’re also putting yourself at risk of being usurped by rival real estate professionals who DO grasp business finance. They’ll go out and borrow money, find private equity, factor their commissions, and raise funds in order to develop. And if they succeed in doing so, you will fall behind because you tried to finance your growth on your own.

Business owners who have small aspirations usually only achieve small successes. If your goal is to stay small, then stop reading this article. However, if you want to grow your business and take over the market, you shouldn’t use all your personal cash reserves to finance growth in your real estate business like many smaller businesses do because it’s not a good idea. Larger businesses never Do this, so why should you?

Thus, you should exercise caution when heeding “the experts” in your field. Even though their intentions may be good, following their tips could stunt your progress and impede success. It’s not embarrassing to take out loans to finance growth; large companies often do so to stay ahead of the curve and beat the competition.

Summary – Why Use a Real Estate Commission Advance?

Waiting to get paid is just lost time you can never get back. The faster you get some of your money into your bank account, the sooner you can do your next deal, finance your marketing, get cutting edge technology, and top notch talent on your team. A real estate commission advance is one way to help get the money you have coming to you in your cash account now, so you can fund your operations and future growth.

Real Estate Agents experience cash flow problems because they have bills that need to be paid at regular intervals, but their payments come in irregularly. Having outgoing expenses faster than incomings causes cash flow issues. The solution to cash flow problems for realtors is to “finance the gap” between signing a deal and getting paid at closing. You can do this with business lines of credit, bank loans, SBA backed bank loans, credit cards, and using real estate commission advances.

If you are wondering why use a real estate commission advance, of the options available to you, a real estate commission advance is the easiest to qualify for, does not require good credit, does not impact your credit rating, and allows you to get cash in your bank account quickly. Plus, they are fast, and incredibly flexible which is important in the real estate business.

Businesses who are debt-free are “asleep at the wheel.” If they were investing in fresh talent, adopting cutting-edge technology, marketing aggressively, and constantly finding new deals to finalize, they wouldn’t be debt-free. Big businesses always finance their operations with “other people’s money.” Why should small companies act any differently?

If your competitor takes advantage of debt, equity, lines of credit, and real estate commission advances but you don’t, you will gradually fall behind them as they gain market share. They will simply “outrun” you, and you will watch their business grow while your business continues to muddle along.

Real Estate Commission Advances are fast, flexible, easy to get, and can help you solve your cash flow struggles and help keep you “in the game.”

What does a Real Estate commission advance application look like?

The application takes about 10 minutes to complete and can be filled out online. It asks for the amount of advance you are looking for, information related to the property on which you are requesting an advance, and the approximate closing date. Information related to the lender and lending officer is also usually requested.

In the application, you will be asked to provide:

- Proper identification, such as your driver’s license

- MLS listing of the property showing the status as “under contract”, “pending”, or “sold”

- Wire instructions (where to send your advance)

- Closing date

- Whether you are representing the buyer or seller.

- Evidence that contingencies have been satisfied.

- Commission sharing agreement or documentation showing net fees owed to you.

Applying with Accel Commission Advance

Once Accel receives your application, their proprietary cloud-based processing system allows them to advance your commission quickly and efficiently, in as little as 24 hours.

What do the underwriters look for on an application?

To confirm that the agent or broker requesting the advance is actively representing buyers or sellers in real estate transactions, underwriters look at data related to the number of transactions that the agent or broker has completed in the last six months and how many active and pending listings they currently have.

Accel Commission Advance requires that an agent or broker has at least one other listing or active deal in the process of closing. The deal must also be scheduled to will close within 45 days. Credit score is not considered in their underwriting process.

How are the fees determined?

Fees are set based on numerous factors, and each case is assessed individually. Accel offers reduced fees as an agent or broker completes more advances with them and establishes a consistent track record. Accel offers competitive fees as low as 8 percent.

How Do I Get My Money from a Real Estate Commission Advance?

Advances will be delivered to your bank account via a wire transfer. Accel gets you paid fast. Overnight funding for realtors is possible, especially for agents and brokers that have already done business with Accel.

How do I Pay Back a Real Estate Commission Advance?

Repayment of the advance happens automatically when your sale closes. The settlement company will receive a commission disbursement authorization signed by your broker instructing them to send a portion of your commission directly to Accel on your closing date. So, there is nothing for you to do. We collect our money directly at closing.

CLICK HERE TO APPLY TODAY

About Accel Real Estate Commission Advance

We are a direct funder, not a broker like most real estate commission advance companies. Because there’s no middleman involved, our fees are among the lowest in the industry, as we pass our savings on to you.

We factor numerous asset classes, helping attorneys, professional athletes, business owners, and of course real estate agents and brokers. Let Accel finance your next Real Estate Commission Advance.

CLICK HERE TO APPLY TODAY

Frequently Asked Questions about Real Estate Commission Advance

Question: Is there a minimum size commission that you advance Real Estate Agents?

Answer: There is no minimum size commission, but the minimum fee is $250.

Question: Is there a maximum size commission that you advance?

Answer: Yes. The maximum amount is $30,000.

Question: Are there any reserve holdbacks?

Answer: Yes, there is a 10% reserve holdback on every advance.

Question: Are there any administration fees?

Answer: There is a $30 wire fee for any outgoing wires. Agents can opt to receive funds via eCheck for no charge.

Question: Are there any application fees?

Answer: No

Question: Do you advance brokers of record?

Answer: Yes, on a case-by-case basis.

Question: Can I advance more than one deal at a time?

Answer: Yes

Question: How much of my Commission can I Advance?

Answer: Up to 80% of net commission due to agent.

Question: How quickly can I get my advance processed?

Answer: Advances are processed in 48 hours or less – majority of advances fund same day.

Question: Are your advances restricted to a closing within 90 days?

Answer: Within 120 days.

Question: Do you require a minimum size deposit?

Answer: No