Post Settlement Funding for Plaintiff Attorneys – Why Law Firms Use Post Settlement Funding

Why Plaintiff Attorneys use Post Settlement Funding – Plaintiff attorneys use post settlement funding Primarily for two reasons:

Reason #1: Plaintiff Attorneys use Post Settlement Funding to help manage cash flow.

Reason #2: Plaintiff Attorneys use Post Settlement Funding to finance future growth.

Managing Cash Flow

What is Cash Flow for Plaintiff Attorneys

People in business talk about cash flow a lot, but very few people truly understand what it means.

Cash flow is the term used to describe the “flow” of cash into and out of your bank account.

What is Cash Flow management?

Cash flow management is any activity used to regulate these two flows of cash (cash flowing – cash flowing out).

The goal of cash flow management is to keep the money flowing into the account faster than it leaves.

What are Cash Flow Problems?

Cash flow problems are the only real reason people care about cash flow at all. Your law firm has “cash flow problems” any time the money is flowing OUT of your bank account faster than money flows IN to your bank account.

What Causes Cash Flow Problems for Plaintiff Attorneys?

Cash flow problems for plaintiff attorneys have two primary causes:

Problem #1 – Expenses Too High.

The first type of cash flow problem a plaintiff attorney might encounter is caused by expenses being too high. Of the two major types of cash flow problems a law firm may experience, this is the better problem to have because there is a lot you can do to control it. Painful as it may be, you can often find ways to cut enough expenses to solve this cash flow issue.

Problem #2 – Timing of Cash Flow

The second type of cash flow problem is caused by the “timing” of cash coming into the bank account versus the timing of the money flowing out. This is a much more difficult cash flow problem to solve. When money flows into your bank account slowly and at irregular intervals (timing), and the money leaves your bank account quickly and at regular intervals (like payroll), then you will have a cash flow problem.

And this perfectly describes Plaintiff work. You get paid slowly, and at highly irregular intervals. Cash only comes into your bank every now and then, and even though it is often in large amounts, there is no way to predict when it will arrive or how often. Conversely, your expenses (rent, payroll, personal salary, expert witnesses, travel, etc.) must be paid every few weeks (in most cases).

The net effect is that you have money constantly leaving the cash account and at regular intervals, but money might only enter the cash account a few times per year (or less). This is a cash flow problem.

You can’t solve this type of cash flow problem by increasing business – because more sales would exacerbate this type of cash flow problem, not solve it.

Why Cash Flow for Plaintiff Attorneys Matters

Businesses fail when they run out of cash, and for no other reason. When you are out of money, you are out of the game.

Businesses do not close because of lack of profit, or even lack of sales (although this contributes to the problem). Businesses close when they run out of cash. If you have cash in the bank to pay bills, employees, and vendors, you are still in the game.

Companies like Amazon and Uber never make a profit. But they have massive amounts of cash coming directly into their bank account every minute of every day. A company like that will never go out of business because they will ALWAYS have cash to pay employees, bills, and vendors. They might overextend themselves and need to lay people off, or make some other cuts, but they will never close.

Contrast this with being a plaintiff attorney – you may only have cash deposited into your bank a few times per year from your work. And you can’t be certain when the next check will be deposited into your bank account. This “gap” between doing work and getting paid must be navigated carefully or you may end up closing your law firm even though on paper, you are worth millions. It doesn’t matter if a lawsuit you won six months ago is going to pay you millions of dollars – when you can’t pay the rent or make payroll, your law firm will close its doors.

How to Use Post Settlement Funding to Reduce Cash Flow Problems

Remember the basic law firm cash flow problem? Money goes out fast and comes in slow.

One of the ways law firms can help “bridge the cash flow gap” is by using legal funding companies to take out a post settlement advance.

How Post Settlement Funding for Plaintiff Attorneys Works

When you win a case, or have billed a client, and are waiting to be paid from either the lawsuit or the client, you can “sell” all or a portion of the money that is owed to you to a legal funding company like Balanced Bridge Funding for a fee.

You get some of your money right away, and when the bill is paid by the client or lawsuit, we get paid directly from the client or the attorney of record (in the case of a lawsuit settlement award).

It is as simple as that. You get your money now, and we get paid to do the waiting for you.

This type of transaction historically was known as factoring. Most industries take advantage of using factoring companies to help solve their cash flow challenges. Law firms who operate on a contingency fee basis are no different.

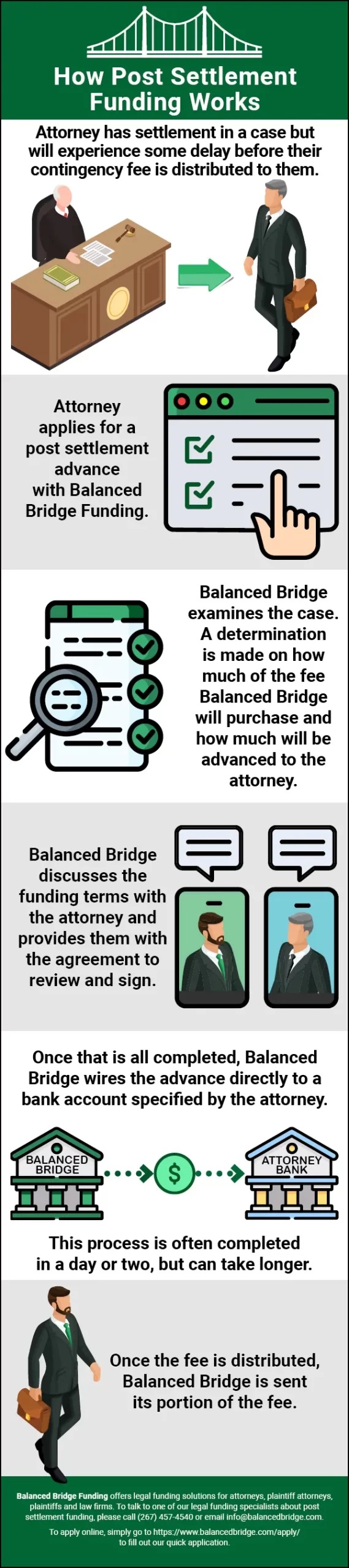

Infographic – How Post Settlement Funding for Plaintiff Attorneys Works

Let Us Explain How Post Settlement Funding Works

Let’s say you are going to receive $100,000 in fees from a settlement at some point, but you need some of that money now.

• Attorney has settlement in a case but will experience some delay before their contingency fee is distributed to them

• Attorney applies for a post-settlement advance with Balanced Bridge Funding.

• Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney

• Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

• Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Is Post Settlement Funding for Plaintiff Attorneys a Loan?

A post settlement advance for Plaintiff Attorneys is not a loan. When you receive a settlement advance, the legal funding company does not loan you money. The fees you are owed from a lawsuit are considered an asset (like a stock or bond). And just like any other asset you own (like a stock, bond, or your car or house); you can sell it to someone else for an agreed price.

Using the example from the infographic above, this person agreed to sell $50,000 of their fees for the price of $45,000. The settlement advance company now OWNS the right to $50,000 of the lawsuit settlement and will receive their $50,000 directly from the case attorney of record. They bought the asset from you for $45,000 and will receive $50,000 from the attorney of record when the settlement award is paid, earning the legal funding company $5,000.

Who Pays the Legal Funding Company Back?

Remember, this isn’t a loan. As a post settlement advance company, we purchase the asset from you, and then we own it. You do not have to pay us back; instead, we notify the attorney of record of our ownership of a portion of your settlement award, and when the defendant pays, the attorney of record will pay us directly. There is nothing for you to do.

Why Plaintiff Attorneys Use Post Settlement Funding – To Fund Future Growth

Big businesses never hesitate to use “other people’s money” to finance their future growth. In fact, they count on it. They raise private equity, sell bonds, sell equity, and take on debt to finance their future growth. This is commonly referred to as “leveraging.”

When you think of “leverage” what do you think of? Non finance people generally imagine “prying” something or “moving” something with a large lever. In fact, the bigger the lever the easier things move. That is what using other people’s money is – it is a lever you use to move your law firm forward.

Think about it like this – if you want to move something on your own, without a lever, you have only as much power and strength as you have in your arms, legs and back. Even if you are the strongest person in the world, you will be severely limited in how much you can do. But take that same object and move it with lever, and that same strong person can move nearly anything if the lever is long enough. The “leverage” provides a multiplying effect to the individuals power.

This is the effect using other people’s capital has on trying to “move” your business forward. You can only go so far using your own financial power to move ahead. But if you “leverage” other people’s money against your future earnings, you can grow much more rapidly.

Plus, if you decide to rely solely on your own financial strength, and one of your competitors goes out and uses leverage, they are simply going to outpace your growth. They will continue growing, taking market share, expanding into new markets, hiring better talent, taking on the best clients and the best cases, while you fall further and further behind.

Don’t Be Debt Averse

Did you know that being debt free as a business is not a desirable state to find yourself in? Being debt free might be desirable on a personal level, but as a business, you should never find yourself debt free.

Why shouldn’t your business be debt free? Because if a company is debt free they are not:

- Updating their technology

- Hiring the best people they can

- Taking risks

- Growing market share

- Entering new markets

- Opening new branches

- And more!

How do you know this? Because if you were updating technology, expanding into new markets, hiring the best and brightest new lawyers, and entering new markets, you wouldn’t be debt free. When finance experts see a company that is debt free, they see a company whose leadership is asleep at the wheel, coasting on their past successes, or is out of touch with the rest of the industry. Finance experts are always on the lookout for debt free companies, because they know if they take over the company and then start using leverage to grow, that there is lots of room for growth and expansion, which makes their holdings more valuable.

So unless you own a “lifestyle” law firm, that only exists to pay for your lifestyle, you should embrace the idea of using leverage to grow.

Using Post Settlement Funding to Fund Growth

Once a case concludes, and a judgment is ordered, you should be taking out a post settlement advance right away to get that money into your cash account so you can execute your future growth initiatives.

It is common to hear people say, “time is money.” But what does that really mean? Maybe instead they should say “lost time equals lost money you can never get it back.” Because this is what “time is money” really means; it means every moment you spend waiting to get paid, you are not marketing, recruiting, investing in technology, etc., and you can never get that time back. It is lost.

At a minimum, your future success will be delayed. But if you are low on cash because you are waiting to get paid, you might miss some huge opportunities as they come along because you are not in position to capitalize on them.

Wrong Thinking About Financing Growth Delays Growth

Gary Vaynerchuk (Gary Vee) was talking in a video clip about financing mistakes he had made. He said something like this:

“Every month I saw that Google Ads bill come in for sixty, seventy, eighty thousand dollars, and it freaked me out. I just kept seeing all that money leaving. So, I decided to try and cut it down as much as possible. And you know what, I was so wrong. So wrong. I was totally thinking about it the wrong way. Instead of trying to reduce my ad spend, I should have been figuring out how to spend two million or three million on Google Ads every month. And if I had, my business could have been where it is now three years ago.”

Gary Vaynerchuk

This is what we are talking about when we suggest using debt and financing to fund your future growth instead of sitting around waiting to get paid from lawsuits you’ve already won. Every moment you spend waiting, just prolongs your wait “down the road.” So instead of selling the law firm three years from now, maybe you’ll be selling it six years from now instead. Instead of being the number one law firm in your city, maybe you’ll be number six forever.

Without financing your future growth, it is likely your law firm will simply muddle along, having a few big victories here and there which are punctuated by anxiety ridden days in the future as you watch your cash account go down, down, down; hoping and waiting for another case to come in and be concluded, and then the whole cycle will start over again.

Summary

Plaintiff Attorneys use Post Settlement funding primarily to solve cash flow problems, and to fund their future growth.

Cash Flow Problems

Cash flow problems are caused by having regular expenses (like rent and payroll) and irregular income (like waiting on a case to settle and then for the defendant to pay).

Funding Future Growth

Large businesses never hesitate to use “other people’s money” to finance their future growth and if you want to growth your law firm, neither should you. Trying to fund future growth using only your own money is going to delay your future success and may prevent it entirely as other competitors use debt and private equity to raise capital and take market share from you.

Lost Time = Lost Money

Time spent “waiting” on money can never be recovered. It is lost forever. This is what is meant by time is money – any time spent waiting on money is lost and will inevitably prolong the time it takes your law firm to become successful. You need to be marketing now, adding the best and brightest talent now, entering new markets now, adding branches and divisions now; you can’t do that while you sit back and wait to get paid.

About a Post Settlement Funding for Class Action Lawsuit Plaintiff Attorneys with Balanced Bridge Funding

A Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Post Settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle Free Application

In most cases we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

Post Settlement Funding for Plaintiff Attorneys

If you think our post settlement funding solution could be the right fit for you, please call one of our legal funding specialists at 267-457-4540 or to apply online, simply CLICK HERE and fill out our quick form application.