Understanding Legal Funding for Plaintiffs and Plaintiff Attorneys

Legal Funding is the term used to describe multiple types of financing options offered to attorneys and plaintiffs to help them gain early access to some of their funds. Legal funding is used by plaintiff attorneys to manage cash flow struggles inherent in contingency fee work. Plaintiffs use legal funding to get early access to some of their settlement money while they are waiting on a lawsuit to conclude and funds to be distributed.

Lawsuits advance slowly and take a long time to conclude. Even after the case settles or a settlement award is ordered, it can take a long time for defendants to pay what they owe. Legal funding helps ease the financial burden incurred while waiting for a lawsuit to conclude and for defendants to pay up.

Lawyers can use legal funding to get some of their money back in their bank account to take on bigger and better cases, pursue better settlements for their clients, finance operations, and continue expanding their law practice. Plaintiffs can use legal funding to help pay bills (including medical bills from the injury), build new skills, go back to school, relocate, or help recover from injuries.

Are There Different Types of Legal Funding?

Yes, there are multiple types of legal funding but in this article, we are focused primarily on two categories: Pre-settlement Funding, and Post Settlement Funding.

What is Pre-Settlement Funding?

Pre-settlement funding can be split into two categories: Pre-Settlement Funding for Attorneys and Pre-Settlement Funding for Plaintiffs.

Pre-Settlement Funding for Plaintiffs – Pre-settlement funding for plaintiffs is a financial vehicle where the plaintiff (the person who has brought the lawsuit) receives funds right away to help cover medical bills or other expenses brought about by their injury. To receive pre-settlement funding for plaintiffs, the plaintiff attorney must have a pretty solid case. Because if the attorney loses the case, or fails to reach an adequate settlement, the plaintiff gets to keep the money, even though they didn’t win their case. This is known as a “non-recourse” transaction.

If you are injured, you may have large medical bills because of an injury. You might also not be able to work in your current occupation. So imagine you have been injured because of someone else’s negligence, and you find a lawyer who filed a lawsuit, but you can’t work, and the medical bills are piling up. You can literally go into bankruptcy and ruin your credit and lose your possessions through no fault of your own. Pre-settlement funding for plaintiffs is used exactly for this type of scenario – to help pay for medical bills or living expenses (or even re-education) while you are waiting for your lawsuit to conclude.

How can a Plaintiff Take Out An Advance on a Case They Haven’t Even Won yet?

That is a great question. The answer is good plaintiff attorneys have gotten fairly adept at recognizing cases they are going to win versus cases that are dubious. Bigger law firms have also had a lot of experience with all types of cases and can develop reasonably good estimates of how much a case might settle for based on other cases they have experienced. Though they cannot provide you with third party litigation financing themselves, they maintain relationships with financial entities who can and will advance you money based on how strong your case is, and how much they believe the case may settle for. This is risky for the financial entity of course since they can’t get any of their money back if the attorney doesn’t win, but they weigh the risk and the reward (fees) of these types of transactions and proceed accordingly.

Pre-Settlement Funding for Plaintiff Attorneys – Pre-settlement funding for plaintiff attorneys is used by attorneys to help take on big cases and to make sure they win. Lawsuits are expensive, and plaintiff attorneys work on a contingency fee basis, meaning they don’t get paid until they win a case. But hiring expert witnesses, court costs, private investigators, videographers, court displays, audiovisual equipment, E-Discovery companies, travel, Etc, all cost a substantial amount of money. Pre-settlement funding for plaintiff attorneys allows the attorney to receive a capital injection from a third party to help them cover these costs, hire the best witnesses, hire the best E-Discovery firms, and help make sure they win the case. Third party investors get the benefit of a new investment stream, and the law firm gets to win cases, win larger settlements (because they can afford to wait them out), and keep growing their law practice.

Plus, because large cases like class action lawsuits are extremely expensive and can take five or even ten years to settle, smaller law firms may be less likely to pursue this type of work. But with the backing of legal funding, they can take on large cases, hire the best experts, hire investigators, hire extra lawyers just for the case, and, afford to wait it out as long as it takes to get their clients the best settlement possible.

What is Post Settlement Funding?

Post settlement funding can be split into two categories: Post Settlement Funding for Attorneys and Post Settlement Funding for Plaintiffs.

Post Settlement Funding for Plaintiffs – Post Settlement Funding is so named because it is funding option plaintiffs can take advantage of after a case has concluded or settled. Most people don’t know how long it takes to receive a check once a lawsuit concludes. The truth is, it can take months or even years. In the massive sexual assault class action lawsuit recently settled by USC, it took some plaintiffs up to eighteen months AFTER the case settled to receive their money. And that was after waiting on the lawsuit to wind its way through the court system and finally settle. That is a long time to wait on your money. After a lengthy case, a plaintiff might need rehabilitation to help recover from their injuries, and they might want to move, or possibly go back to school. Post Settlement funding allows them to cut the wait time down between the case concluding and receiving their funds by taking out a post settlement advance on some of their money (for a fee).

Post Settlement Funding for Plaintiff Attorneys – Post settlement funding for plaintiff attorneys is used by attorneys to help get some of their money in the bank once a case concludes. Lawsuits advance slowly through the court system and can take years to settle. But even then, once the case concludes it can still take YEARS to get paid. Lawyers who work on contingency fees have had to finance the entire court case to win in the first place; laying out cash the entire time. And then, there can still be a long waiting period to get their money. Post Settlement Funding for Plaintiff Attorneys allows lawyers to take out an advance against the money they are owed to pay bills, continue operations, and fund future cases to keep the law firm growing.

How Does Legal Funding for Attorneys?

Legal funding works a lot like factoring receivables, only for lawyers. When you factor your accounts receivable, you sell them to a third-party financier at a discounted rate, and they collect the full amount in the future.

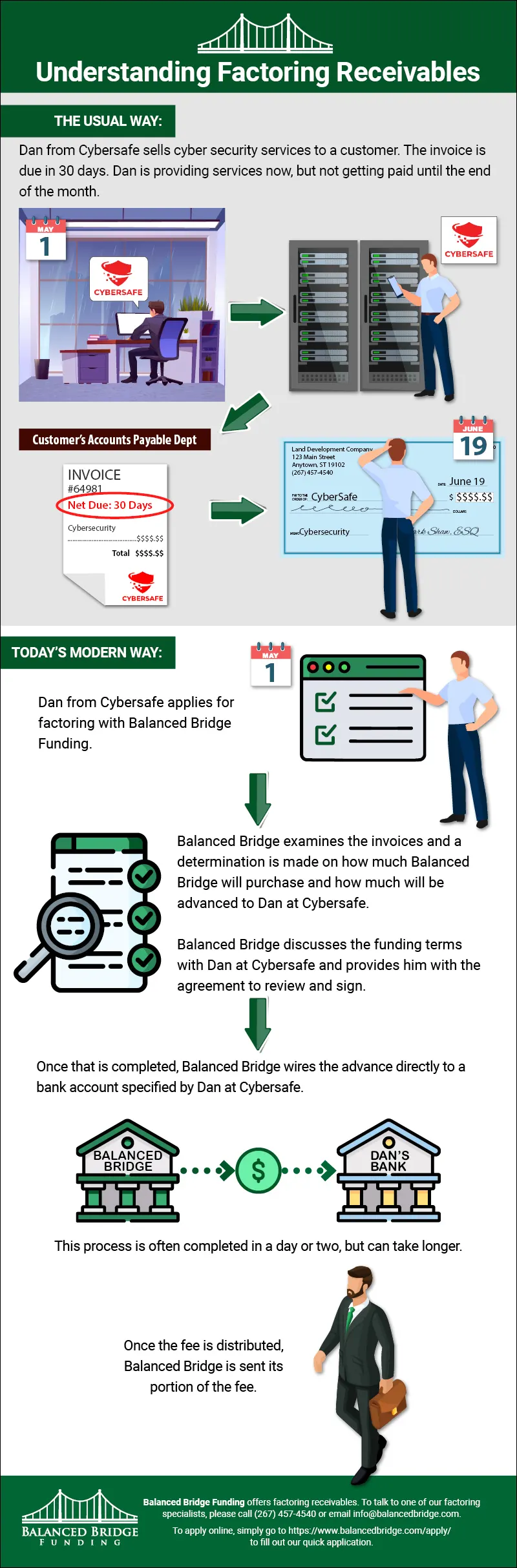

Understanding Factoring Receivables Infographic

- A business sends its invoice to a client marked due in 30 days.

- The business applies for factoring with Balanced Bridge Funding.

- Balanced Bridge examines the invoices. A determination is made on how much of the invoices Balanced Bridge will purchase and how much will be advanced to the business.

- Balanced Bridge discusses the funding terms with the business and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the business.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

This is how factoring receivables works. You get part of your money now by selling rights to the money you are owed in the future at a discounted rate. This is how legal funding works as well. Your settlement award or judgment from a lawsuit is considered an asset, just like a stock or bond is considered an asset. And just like a stock or bond (or accounts receivables), you can sell the rights to your settlement award or judgment at a discount.

Let’s imagine you are a plaintiff attorney and you win a class action lawsuit for your client. You want some of that money now, so sell part of your pending attorney fees to a legal funding company (like Balanced Bridge Funding) at a discount.

Here is an example of how legal funding for an attorney operates*:

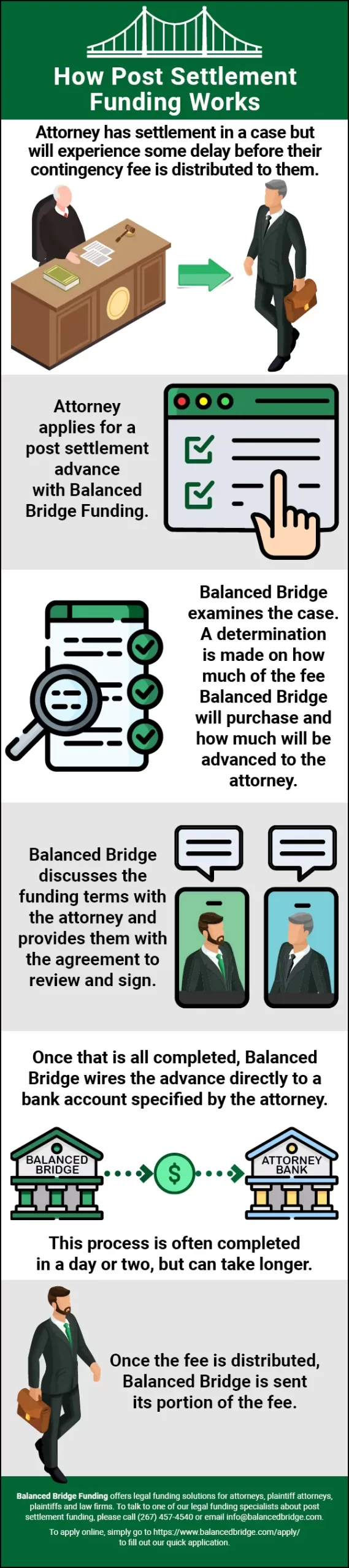

- Attorney has settlement in a case but will experience some delay before their contingency fee is distributed to them.

- Attorney applies for a post-settlement advance with Balanced Bridge Funding.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney.

- Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

- Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

How Does Legal Funding for Plaintiffs Work?

Legal funding for plaintiffs works the same as legal funding for attorneys. Your settlement award or judgment from a lawsuit is considered an asset, like a stock or bond, is considered an asset. And just like a stock or bond, you can sell your asset to a third party at an agreed upon price.

Let’s imagine you were a plaintiff involved in a class action lawsuit. First, you had to be admitted to the class. Then the case may have dragged on for years in court. And finally, the case concludes either by settlement or judgment. You won!

But that is only part of the story. Even though you’ve won, you won’t generally get any money for some time. In fact, it can take months or even years to receive your money. But what if you need some of that money now to pay for medical bills, education, or relocation? With Legal Funding for Plaintiffs, you have the option to get some of your money now. The way it works is, you sell part of a pending settlement to a legal funding company (like Balanced Bridge Funding) at a discount.

Here is an example of how Legal Funding for Plaintiffs Operates*:

- Plaintiff has settlement in a case but will experience some delay before their award is distributed to them.

- Plaintiff applies for a settlement advance with Balanced Bridge Funding.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the plaintiff

- Balanced Bridge discusses the funding terms with the plaintiff and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the plaintiff

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Is Legal Funding a Loan?

No, Legal funding is not a loan. Legal funding is an advance.

Unlike a loan, legal funding doesn’t come with monthly payments, points, or upfront fees. There are fees associated with the advance (usually to cover the costs of underwriting), but typically, those costs will be paid when the advance is due for repayment.

Also, as we talked about above, legal funding is a non-recourse process. So, plaintiffs and attorneys will not be asked to repay their advances if a case doesn’t settle favorably or if an obligor cannot pay the full award or fee amount.

Why not just go to the bank?

Though bank loans and lines of credit (LOCs) are the more common options for those struggling with cash flow, attorneys and plaintiffs may find that dealing with the bank is not the easiest or most practical choice.

Banks usually require loan and LOC applicants to present non-liquid assets, such as bonds, stocks, and real estate. These assets, used as collateral, are used to guarantee that the applicant will have something of significant value with which to pay back the loan.

Some plaintiffs and plaintiff attorneys may have no problem coming up with the necessary collateral to secure a loan, but others may find this difficult, or might not have the right type of collateral. For example, many attorneys rent offices or invest much of their capital into future cases. Banks do not accept rental spaces or future receivables as collateral.

Credit checks are another potential problem that plaintiffs and plaintiff attorneys might face when applying for a bank loan or line of credit. Plaintiffs who recently lost jobs had to leave work due to injury, or are covering other case-related expenses may have unbalanced credit scores that would be unacceptable on a loan application. Similarly, attorneys, who often finance their own business expenditures, may have low credit scores because of work-related expenses.

While it is of course possible for a bank to approve an attorney’s or plaintiff’s loan application, and though banks typically have lower interest rates than alternative financing options, the difficult application process and monthly repayment requirement may deter some plaintiffs and attorneys from pursuing a bank loan or line of credit.

When To Use Legal Funding

Litigation is an uncertain and notoriously lengthy process. A typical personal injury case, from filing to settlement distribution, has a two-year life span; MDLs, class actions, and malpractice cases take even longer. Factor in processing paperwork for minors, governments, and international entities, and a case’s lifespan may extend past ten years.

Waiting over two years for a case to reach a decision is not just an inconvenience; for a plaintiff who was injured on the job or for a solo practitioner, time without access to a settlement award or an attorney’s fee could be crippling.

Legal funding provides plaintiffs and attorneys a means of supporting themselves while lawsuits are in session or settlements are pending. For many, funding advances can make the difference between getting by and thriving.

Legal Funding Helps Attorneys Keep Their Businesses Alive

Plaintiff’s attorneys are not just legal professionals: they are also businesspeople who need capital to manage their practices. The act of running a business is an extra challenge for contingency fee attorneys, who sacrifice their time, expertise, and money to build solid cases for their clients without any guarantee of payment.

The different types of litigation financing were created to fit the needs of all contingency fee attorneys, solo practitioners, and larger firms alike. With the help of a funding advance, attorneys can hire expert witnesses, cover discovery costs, pay for advertising and administrative costs, and maintain office space without worrying about running low on capital.

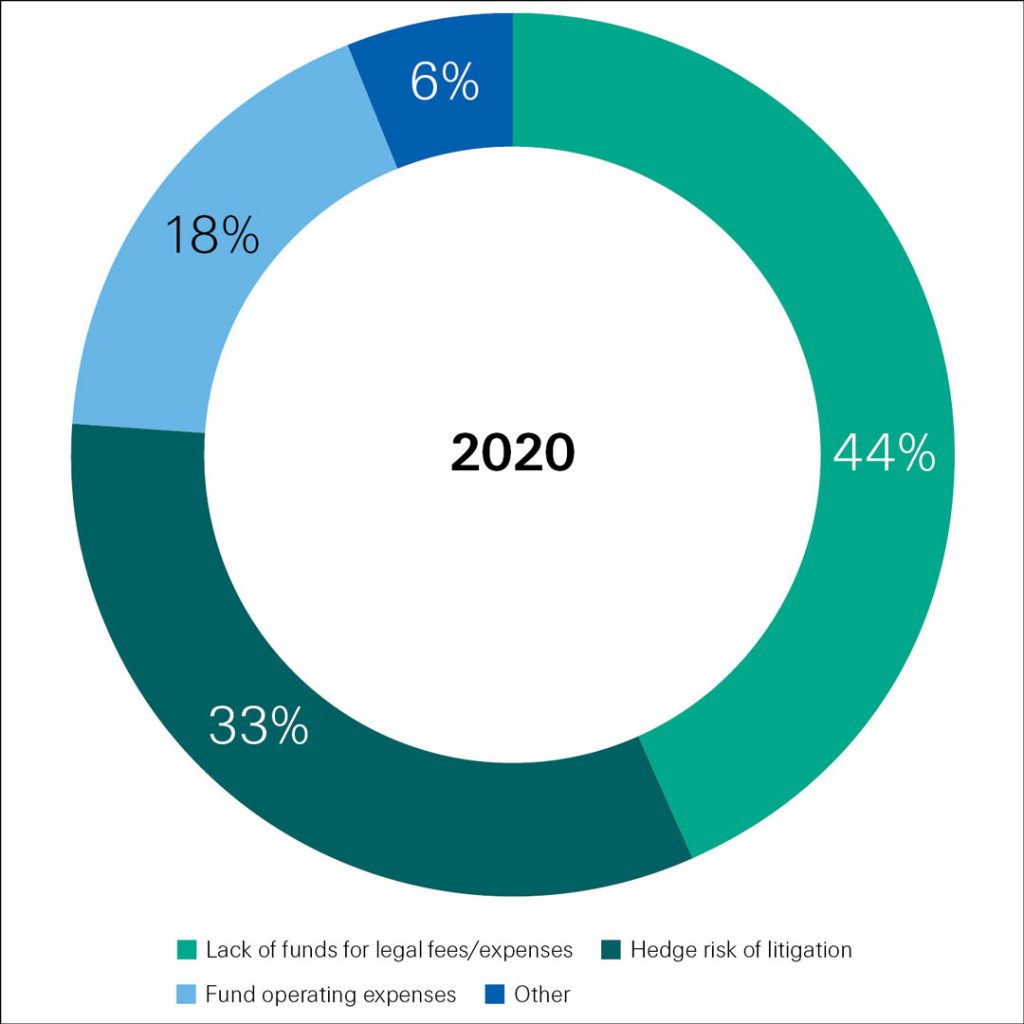

Reasons Attorneys Use Legal Funding

Source: https://www.claimsjournal.com/app/uploads/2021/12/swissre.litigation.funding2021.pdf.pdf

Lawsuit Funding Lets Plaintiffs Live Their Lives

Plaintiffs turn to the legal system to seek compensation after suffering an injury due to negligence, losing a loved one in an accident, experiencing medical complications after surgery, or enduring any number of injustices.

But even though litigation often provides plaintiffs with financial compensation, plaintiffs have to wait for years for a decision or settlement to be made and then wait even longer for the funds from a settlement to be distributed.

Legal funding can be used to make up for lost wages, pay medical bills or necessary surgeries, or cover daily expenses. Gaining immediate access to some of your money by using a legal funding advance can help reduce some of the burden by shortening the waiting time, which allows plaintiffs to focus on living their lives and moving past the injury that brought about the lawsuit in the first place.

Most people don’t have much money in savings. A recent article on the CNBC website suggests that people have between $2,500 and $15,000 in their bank account, the higher savings amount being more common among older people. What people don’t realize is that if you are injured at work or because of someone else’s negligence, you can lose your job. Workers compensation often doesn’t pay much. And you might never be able to return to your occupation again. And although you might find a remedy and get compensated through the court system, while you are waiting for that to happen (which can take years), it is entirely possible to be ruined financially while you are waiting. If you can’t work, and workers compensation doesn’t cover your expenses (or you don’t qualify because you were injured outside of work), how are you going to live? Even if you had $15,000 in the bank, how long would that last you with no income? A few months?

Legal funding for plaintiffs can help with all of this. It can get some money in your hands now to cover your expenses while you are going through the legal process. Your creditors don’t care why you can’t pay your bills – they just know that you can’t, and your credit score will be impacted, which will stay on your credit report for up to seven years, reducing your ability to use bank loans in the future. So it isn’t just that your immediate situation can be drastically impacted while you wait on a remedy from the judicial system, your future can be impacted as well if you have late payments or defaults on your credit report – those stay on there for up to seven years.

Legal Funding Adds Confidence for Lawyers

Legal funding allows attorneys to have confidence that they can take on a big case and stay in the fight for however long it takes to win. Plus, they often reach larger settlements for their clients because they have the backing to get the best expert witnesses, create incredible courtroom displays, and do a thorough investigation into the matter. It isn’t uncommon for plaintiff attorneys to avoid taking cases because they know they can’t afford to take on a long and costly lawsuit. They simply don’t have the money to take it on because they know they will run out of money long before the case can settle and they can receive their legal fees.

Some plaintiff attorneys are forced to accept lowball settlements because they are low on cash and need to take what they can get because they are running out of time because they are running out of money. But with legal funding, plaintiff attorneys can stay in the fight for as long as it takes because they have solid financial backing and are in no danger of running out of money while a case drags on.

Attorneys delay cases all the time. These “stall tactics” can put pressure on plaintiff attorneys and plaintiffs alike, especially if they are short on funds, causing them to take offers lower than what they could have received if they had more cash in the bank. Legal funding is a great way to make sure you have as much capital as you need to endure these tricks and tactics and get the best settlement award you can achieve.

With the assistance of legal funding, attorneys can spend more money and time on their cases. Plaintiffs who opt for legal funding can afford to hold out and wait for a better settlement.

Legal Funding is Favorable to Lawyers

Unlike banks, who may require non-liquid assets as collateral to secure a loan or line of credit, legal funding companies accept case inventories as collateral. Legal funding firms understand the potential value of pending settlements and verdicts, so they can accept case inventories as proof that solo practitioners or larger law firms will be able to repay advances.

Legal Funding Companies do not perform personal credit checks as part of an application. Funding advances are business expenses, not personal expenses, making personal credit checks unnecessary. Moreover, in most legal funding arrangements, attorneys are not directly responsible for repayments; rather, payments are directly taken from attorney escrow accounts, administrative accounts, or obligor accounts.

Legal Funding For Plaintiffs

As mentioned above, legal funding companies will accept future settlement awards as collateral. As with attorney funding, personal credit checks are unnecessary for plaintiff funding. Legal funding companies receive their money directly from the plaintiff’s obligor (usually an insurance company or corporation). Because of this, they do not need to evaluate whether the plaintiff has enough money to make a payment, or worry about not getting paid, making credit checks unnecessary.

Conclusion

There are two primary types of legal funding: Pre-settlement funding and Post Settlement Funding.

Pre-Settlement funding is utilized by plaintiff attorneys to help finance lengthy and expensive lawsuits, which gives them the opportunity to take on bigger and better cases but also to hold out for however long it takes to get the best settlement for their clients.

Pre-Settlement funding is utilized by Plaintiffs to help cover medical bills, cost of living, re-education, and rehabilitation of injuries, while their lawsuit makes its way through the legal system. Pre-settlement funding is a non-recourse transaction, meaning, if their lawyer doesn’t win their case, the plaintiff doesn’t have to pay any of the pre-settlement funding money back.

Post Settlement funding for Attorneys is used by lawyers to help recoup some of their money from cases they have won, but the defendant has not yet distributed their funds. This allows them to finance operations, and continue growing their law firm. By the time a case settles, law firms have put out a lot of money to win the case. Post Settlement Funding allows them to recoup some of their money right away, and invest that money in operations and growth.

Post Settlement Funding for Plaintiffs is used by plaintiffs who have won a lawsuit against a defendant but are having to wait to receive their funds. Plaintiffs use post settlement funding to pay bills, relocate, change careers, and more. They’ve waited a long time for their case to finally conclude, and often with much drama and back and forth. Post settlement funding allows them to get access to some of their money right away rather than waiting months or years to get paid by the defendant in a case.

Not a Loan – Neither Pre-settlement funding nor post settlement funding are loans. Instead, the plaintiff or plaintiff attorney is agreeing to sell part of their future settlement at an agreed upon price. There are no points, payments, or monthly accrued interest to pay. Plus, the third party legal funding company is paid directly from the attorney of record for the case, so there isn’t anything for the plaintiff or plaintiff attorney to do once the case finally distributes the funds.

What Types of Legal Funding Does Balanced Bridge Funding Offer?

First, let’s begin with the type of funding we DO NOT offer, which is pre-settlement funding. We do not offer pre-settlement funding for plaintiffs, nor do we offer pre-settlement funding for attorneys. This is not our specialty, but there are many options out there for pre-settlement funding for both plaintiffs and plaintiff attorneys.

Some of Our Legal Funding Options Include:

- Post Settlement Funding for Attorneys

- Post Settlement Funding for Plaintiffs

- Attorney Line of Credit (conditions apply)

- Voucher Funding (conditions apply)

- Loans for Attorneys

Attorney Line of Credit Through Balanced Bridge Funding

A law firm line of credit is specifically designed to help contingency fee attorneys who may not have much physical collateral, but who have spectacular case inventories with high potential gains.

Bank lines are extremely difficult to qualify for unless you have adequate physical collateral and a high credit score. Furthermore, even if you do qualify, you are unlikely to receive the amount of capital you require.

Unlike banks, we believe that your case inventory is not only your most valuable asset but also a great source of collateral. In fact, we look almost exclusively at your case inventory when determining your line of credit, not your personal assets. That also means that your credit score has a limited impact on whether or not you will be approved for a credit line.

Learn More About an Attorney Line of Credit.

Attorney Voucher Funding Through Balanced Bridge

Private practice attorneys appointed or contracted to represent indigent clients can face payment delays of their fees because the government entity is a slow payer. Unlike public defenders who are government employees and guaranteed a salary, private attorneys are essentially contractors and can face the same issues of payment that affect the general government contracting community.

Since the recession of 2008, governments at all levels faced hardship that required them to cut budgets and reorganize priorities. While the economy has improved since then, factors like the changes in the global economy and the cost of entitlement programs will continue to affect the budgets of local, state, and federal governments. That in turn influences programs like compensating private practice attorneys in a timely manner.

Balanced Bridge Funding offers financing on local, state, and federal government vouchers to private practice attorneys nationwide whose payments have been, are currently, or will be delayed.

Learn More About Voucher Funding.

About the Authors

Balanced Bridge Funding offers legal funding solutions for plaintiffs, plaintiff attorneys, attorneys, and law firms. To talk to one of our legal funding specialists about getting help managing your law firm’s cash flow, please call (267) 457-4540 or email: info@balancedbridge.com