How the Underwriting Process for Post Settlement Funding Works

Underwriting Process Post Settlement Funding. If you’re a plaintiffs’ attorney, chances are that you’re familiar with the cash flow challenges that accompany working on a contingency fee basis.

There are numerous expenses involved with litigating a case. Because you only get paid after reaching a favorable outcome for your client, you must front all case costs and other litigation related expenses, which can put a strain on your law firm’s finances.

Balanced Bridge Funding Offers Solution to Lengthy Payment Delays

Underwriting Process Post Settlement Funding. And even though most settlements payout rather quickly, there are sometimes lengthy post-settlement payment delays, where you may have to wait several months or sometimes in excess of a year before you receive your fee (and this is AFTER you have successfully done your job by negotiating a settlement or winning a verdict for your client).

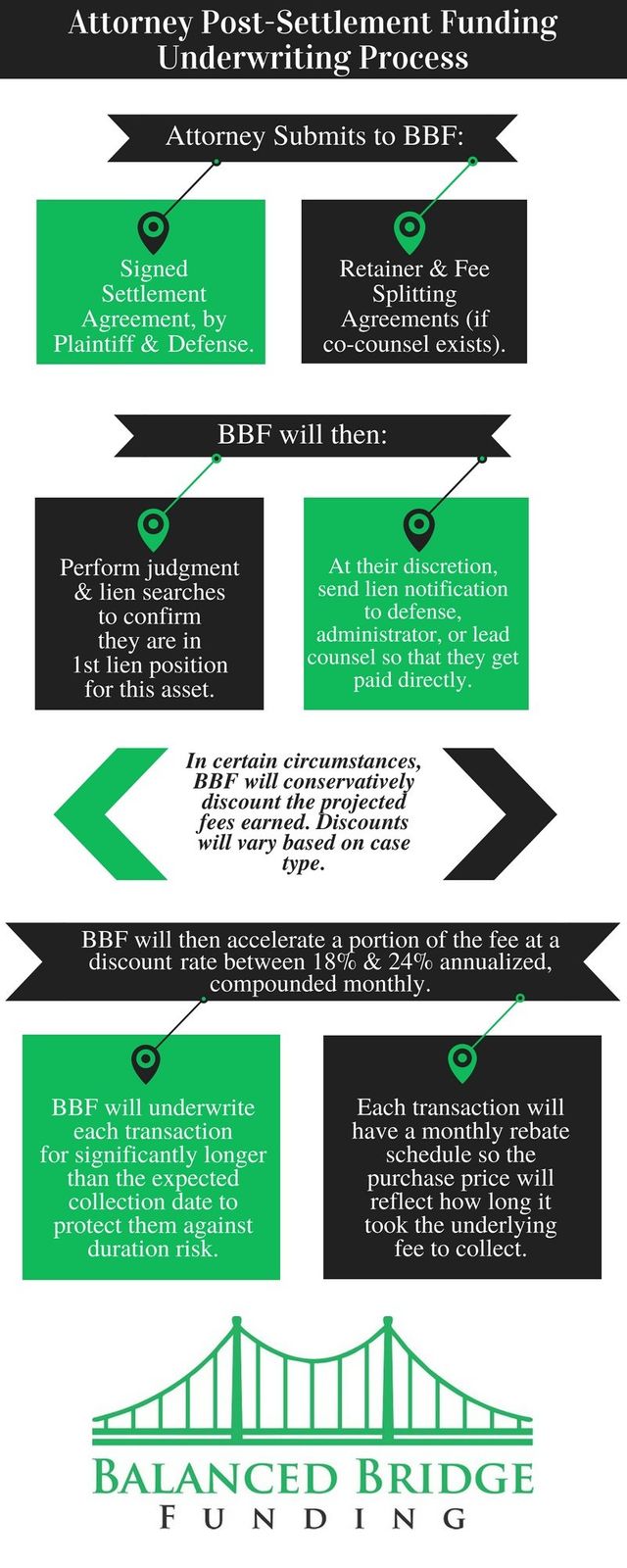

As a solution to such payment delays, Balanced Bridge offers post-settlement funding for attorneys. The below infographic goes into detail specifically about the underwriting process for attorney fee advances.

Transcription of Infographic Text

Here’s the text from the above infographic, written out in paragraph form.

Attorney Post-Settlement Funding Underwriting Process

Underwriting Process Post Settlement Funding. First, the attorney fills out a brief online application, which asks basic questions about you, your law firm, and the case pertaining to your advance. The application also involves submitting necessary documentation including a signed settlement agreement by the plaintiff and defense as well as retainer and fee splitting agreements (if co-counsel exists).

Balanced Bridge will then perform judgment and lien searches to confirm they are in first lien position for this asset. At their discretion, they may send lien notification to defense, administrator, or lead counsel so that they get paid directly.

Discounts in Certain Circumstances

Underwriting Process Post Settlement Funding. In certain circumstances, Balanced Bridge will conservatively discount the projected fees earned. Discounts will vary based on case type.

Balanced Bridge will then advance a portion of the fee at a discount rate between 18% and 24% annualized, compounded monthly. To protect them against duration risk, Balanced Bridge will underwrite each transaction for significantly longer than the expected collection date. Each transaction will have a monthly rebate schedule so the purchase price will reflect how long it took the underlying fee to collect.

Learn More About Balanced Bridge’s Complete Line of Attorney Funding Solutions

Underwriting Process Post Settlement Funding. Post-settlement funding is one of several cash flow options Balanced Bridge offers to attorneys. For a detailed description of their full suite of law firm funding solutions, please read their resource entitled “ Attorney Funding: The Essential Guide .”