Cost to Operate a Trucking Company – Why Trucking Companies Use Factoring

Trucking company operating costs in 2023 are increasing, but it is hard to know how high costs will go. Many of the common expenses involved in owning and operating a trucking company have become extremely volatile, caused by Covid-19, Inflation, and global events keeping diesel fuel prices in a constant state of fluctuation.

Record employment leading up to 2023 has increased the cost of hiring drivers, especially veteran drivers. Companies like Wal-Mart now advertise trucker salaries of $100,000 per year plus benefits.

Covid-19 has created supply chain problems leading to both increased costs, and a lack of availability of parts required to properly maintain and repair trucks.

Fuel prices are volatile – global events like the war in Ukraine have had a serious impact on diesel fuel prices.

The cost of trucks themselves has increased both from inflation and lack of supply.

All these pressures are driving up the cost to operate a trucking company, and many of these problems will most likely persist throughout 2023 and some of them may persist well beyond 2023 (like volatility in fuel prices), making it difficult to properly estimate the cost of operating a trucking company. Perhaps the only phenomenon that has saved the trucking industry from collapse under the weight of increase cost pressure is that demand for goods and transportation of those goods has never been higher.

Like many industries, it is going to become important for trucking companies to have access to capital to help shore up their cash flow, hedge against inflation, hedge against volatility in food prices, and have cash on hand to take advantage of new opportunities as they arise.

The good news is, many third party finance companies have begun seeking out better returns, and have turned away from traditional investments like the stock market, and are offering many types of financing directly to trucking companies (along with many other industries). The benefit to the trucking industry is that these companies are offering quick access to capital. The benefit to the investor is they can achieve better returns than they might get by purchasing stocks or bonds.

To thrive in a volatile world, trucking companies are going to need to start thinking about investing in hiring CFO’s (Chief Financial Officers) who have experience in the futures trading market. Many industries, including the food manufacturing industry, and the airline industry have already made great strides in offsetting their fuel (and oil and grain in the case of the food industry), costs by trading futures on the commodities markets who influence the cost of their inputs (like fuel, corn, oil).

They are trading against the volatility of their inputs and using their gains to offset the day to day price increases they face. Trucking companies who want to thrive going into the future need to learn to do the same.

Rising Costs of Operating a Trucking Company

Record Employment – Everybody Already Has a Job

Record Employment leading into 2022 and continuing into 2023 has dramatically increased the cost of hiring drivers, especially if you are trying to lure veteran drivers away from their current trucking company to come work for you. Companies like Wal-Mart now advertise trucker salaries of $100,000 per year plus benefits for veteran drivers.

With the large corporations owning their own fleets and paying sky high wages, and the larger trucking companies doing the same to try and compete for drivers, it makes it difficult for smaller companies to one, compete for drivers, and two, to afford their salaries at all.

In addition, with great wages, and trucking companies having to compete for drivers, more and more drivers are finding their way to regional routes because they no longer need to do long hauls to make the same amount of money – so they are opting to be at home more because they can afford to do so.

Supply Chain Snarls – Parts, Maintenance, and Repairs

Covid-19 has created supply chain problems leading to both increased costs, and a lack of availability of parts required to properly maintain and repair trucks. Plus, the cost of those parts and maintenance supplies has steadily increased. The popularity of “just in time” inventory was great, and it works – as long as nothing breaks down.

Let’s face it, this is probably the first time in the lives of anyone who is still working (not retired) where getting parts has been a problem. You needed a part, you ordered the part, and FedEx delivered it the next day. Keeping “inventory” of parts was hardly necessary, and inventory, being expensive became an easy target for Chief Financial Officers looking to maintain cash on hand and pare down inventory on their balance sheets. After all, why bother having your cash tied up in inventory when you could plan your maintenance by the week and always get everything you needed.

But this leads to a lot of problems for trucking companies. All of a sudden you couldn’t get parts this week, or in some cases, this year. When trucking companies took notice of this, they began ordering extra parts and keeping them on hand, leading to a further lack of parts available on the market. This in turn, led to increases in the cost of parts available. All of this created additional cost pressure on trucking companies, and it isn’t easy to hedge against all your inputs on the futures market. So now trucking companies who have the money, have parts inventory again, which sucks up cash, doesn’t increase profits, but has become necessary.

The Volatility of Diesel Fuel Price

Fuel is one of the biggest costs (per truck) in operating a trucking company. Unfortunately, fuel prices are volatile and fluctuate wildly. Fuel prices can increase 25% – 50% overnight in some cases. There are very few cost inputs in any industry with this kind of volatility. Fuel costs have become a planning nightmare for every industry that is dependent upon fuel to operate. A trucking company can be profitable one day and be in the red the next day.

The airline industry has to deal with the same thing. What they have done is employed finance experts who can successfully trade futures on oil and use those gains to offset the day to day price swings of fuel they purchase. Large trucking companies have done the same. But smaller companies who do not have futures trading experts on staff tend to just try and wait things out and hope for the best. Too often, the wait is too long and they run out of capital and have to close their businesses.

Lack of Semi Trucks For Sale – and Increased Costs

It isn’t just car dealerships whose lots are empty. Some truck dealers are sold out of trucks one year in advance. And along with a lack of supply comes an increase in demand, which drives up costs. New trucks, just like new cars, are not easy to come by, and their costs are increasing.

This leaves many trucking companies with an aging fleet of trucks. Someone might say, “well they can just repair them and keep them going,” but as we’ve already mentioned, parts are in short supply as well. A truck needing a specific part might sit for weeks or even months waiting on a part – and if it needs a complete rebuild, it might take a year to get everything you need to do the job.

The Cost of Capital is Increasing as Interest Rates Rise – Will a Capital Shortage Follow?

The cost of money is on the rise as well. The Federal Reserve Bank has been steadily raising the Federal Funds Interest Rate to tame inflation. This increases the cost to the banks, and the banks, in turn, raise interest rates on the money they lend to businesses and consumers. The higher the interest rate on loans, lines of credit, and credit cards go up, the more your monthly payments increase, putting additional cash flow pressures on trucking companies who rely on capital financing to run their businesses.

This is generally a compounding problem for individuals and businesses. As the cost of cash increases, banks tend to simultaneously tighten their lending standards; meaning, they tend to lend a lot less money, and they get really picky about who they are going to lend money to. So the cost of your monthly payments goes up, and your access to future capital goes down. And if you run out of cash on hand to pay bills, whether, by cash or credit, you are out of the game.

The good news is, third party finance companies have grown weary of the stock and bond markets. They are seeking out direct equity investments in many industries, including trucking. This gives trucking companies access to fresh capital, and it gives the financiers a way to diversify their portfolios while increasing their return on investment.

Third party investors include direct equity investors, factoring companies, hedge funds, venture capitalists, trust funds, and wealthy individuals who are tired of the stock market (and more). No longer do trucking companies have to rely entirely on the banking industry to fund their operations, which is important, as interest rates rise, and banks inevitably tighten lending standards, trucking companies are going to need access to capital from other sources besides banks and credit card companies.

Basic Model of Cost to Operate a Trucking Company

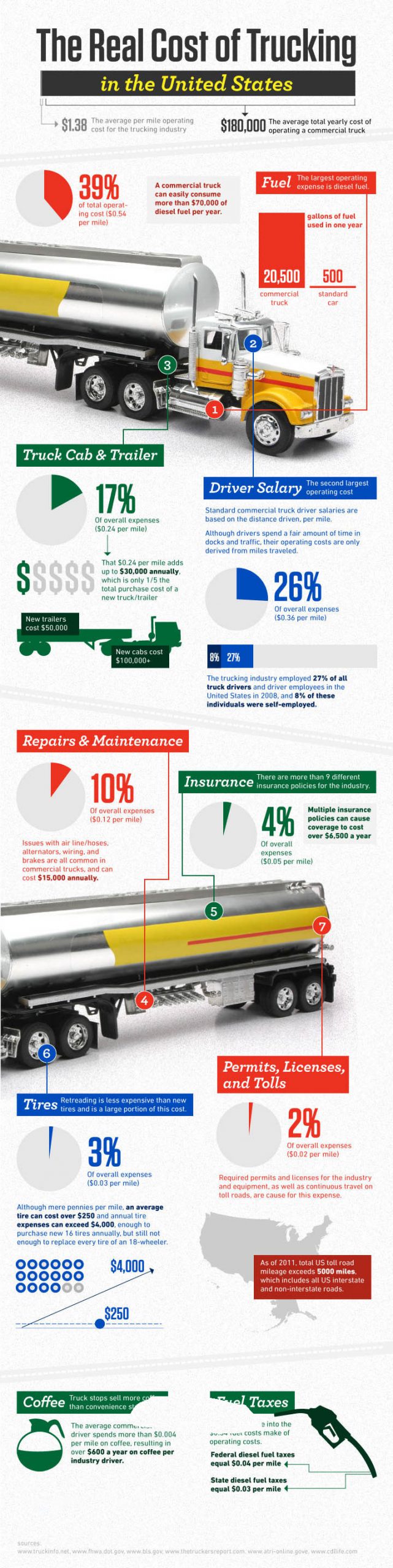

Prior to all of these massive changes that are impacting the cost of operating a trucking company, The Truckers Report put out the following infographic (shared with permission of The Truckers Report), with some numbers that are a good place to start as far as trying to determine how much it is going to cost you to operate one single truck for one year.

According to The Truckers Report, it costs about $1.38 per mile or $180,000 per year to operate one commercial vehicle, with the greatest expense being diesel fuel. See the Infographic below for a breakdown of costs for one truck (per year).

The Real Cost of Trucking in the United States Infographic

The Basic Cash Flow Problem for Truckers

Very few trucking companies get paid up front. You must deliver the load, and then invoice your customer and then wait for them to pay you.

This is the basic cash flow problem for trucking companies – you have lots of money going out of your bank account (or onto your credit cards) to cover the cost of operating a trucking business, and no money coming in until your customer pays their invoices which can be anywhere from thirty days to six months.

Any time you have to cover the cost of performing your work and then wait until later to get paid, you are going to have a cash flow issue.

So let’s talk a little bit more about cash flow in general. It will help you understand the problem clearly, and it will also make you a better businessperson.

What Does Cash Flow Mean?

Cash flow is the term used to describe the “flow of cash” into your trucking company versus the “flow of cash” out of your business. So, when people talk about cash flow, all they are talking about is “money flowing in and money flowing out.”

NOTE – Money doesn’t just mean cash in the bank. Any money you can get your hands on to pay bills is money. That might include lines of credit, credit cards, loans, private equity, and more. If it is available to pay other people, it counts.

When your money is flowing out quickly and flowing in slowly, you tend to have “cash flow problems.” Why? Because the money is “flowing out” faster than it is “flowing in” and if this continues to happen long enough you will run out of funds to pay your bills.

When you can’t pay your bills, you are out of the game. It doesn’t matter if you have a large sum of money guaranteed to you sometime in the future; when you don’t have any of it available to spend, you can’t pay for fuel or make payroll. That is when businesses close their doors – when they run out of funds available to pay for things like fuel and payroll.

Think about it – businesses like Uber and Amazon.com do not have cash flow problems. Cash flows into those businesses every minute of every day from around the world. They always have massive amounts of cash on hand to grow, hire, and expand. Neither of these companies has great profits – in fact, Uber has not turned a profit yet, and Amazon didn’t turn a profit for twenty years. But they are still in business.

Why? Because of the cash flowing into their businesses every single day. But most businesses are not like that. Most businesses are laying out cash nonstop to pay for operations, to make products, and to pay employees, but they have to wait for their money for thirty, sixty, ninety days (and sometimes more). So remember – cash flow is EVERYTHING to a business.

In fact, if you read about some of the largest trucking company bankruptcies in history, you will see that they ran out of money to pay bills and pay for payroll, and then they shut down.

This is the basic cash flow problem – money flows out faster than it flows in, or at irregular intervals.

What is Cash Flow management?

Cash flow management is any activity used to regulate these two flows of cash (cash flowing in versus cash flowing out). The goal of cash flow management activities is to keep the money flowing into the account faster than it leaves.

When most people think about cash flow management, they tend to imagine cost cutting – reducing spending and keeping costs down. But the truth is, you aren’t going to “cut” your way to success.

Most business finance experts focus on keeping cash coming in frequently and as quickly as they can get it. They may do this by borrowing money, selling bonds, selling stock (equity), and factoring their accounts receivable.

Notice I didn’t mention “increasing sales” as a method to solve cash flow issues – in fact, if you are having cash flow problems, increasing sales will actually increase the cash flow problem because you will have to haul more loads, which means more costs upfront for fuel and payroll, and having even more of your money “out there.”

Financing “the gap” to Solve the Cash Flow Problem For Freight Companies

Financing “The Cash Flow Gap” using Credit Cards

To solve their cash flow challenges, trucking businesses need to find ways to “finance the gap” between the customer ordering a load delivered and paying for it. One way to do that is to apply for business credit cards. For a lot of newer businesses, this may be their primary financing vehicle as they will not normally qualify yet for a business line of credit.

Using Business Lines of Credit and Business Loans for Cash Flow Management

A line of credit is basically an “open” or “revolving” loan from a bank or financial institution that allows you access to cash when you need it. When you need money, you withdraw it, and the amount you’ve withdrawn is added to your outstanding loan balance.

Many businesses make use of business lines of credit to ensure they have funds available to them to cover fluctuating costs like a sudden increase in fuel costs or having a minor capital expense (like needing to rebuild an engine). Larger capital expenses however are usually covered by obtaining a capital loan that is secured by the equipment, building, Etc.

Factoring for Trucking Companies

Remember we said earlier that a lot of private investors have begun looking for better returns than they can find with stocks and bonds? Some of those companies have gotten into the business of factoring invoices for trucking companies.

Factoring Companies are third party specialty finance companies that purchase invoices from truckers at a discounted rate, pay the trucking company now, and get paid themselves when the customer pays their invoices.

The best factoring companies will know about trucking companies, and how their operations work, understand a freight invoice, and be able to work with large trucking companies as well as owner operators to help them manage their operations where bank financing may not be the best or easiest option for them to use. This is especially true for smaller companies or owner operators. Some factoring companies may offer incentives like same day invoice processing, low monthly invoice volume, or low monthly minimums.

Here is How A Factoring Company Works

- A customer hires you to ship freight from one location to another.

- You do a credit check with your factoring company to see if the customer’s load qualifies.

- Once you complete the delivery, you send the invoice and paperwork to the factoring company.

- They purchase that invoice, and your company receives cash right away.

- The factoring company then collects the payment from the customer.

Private Equity Investment for Trucking Companies

If you are a trucking company interested in rapid expansion, acquisitions of other companies, or just rapidly expanding into new markets, you may want to consider Private Equity Investors.

These can be hedge funds, venture capitalists, wealthy individuals, pension fund managers, and more. These individuals or funding companies are looking for opportunities to help fund rapid expansion in many industries, and in some cases, may be the only real way for a company to get the funding they need.

Private Equity Investment isn’t just for Silicon Valley Tech Companies. Private equity investors are investing in farms, printing companies, franchises, restaurants, coffee companies, and of course, trucking companies. Anywhere they can find a business opportunity where a company can rapidly expand by getting a massive cash infusion, you will find private equity there.

Summary – Cost to Operate a Trucking Company in 2022 and 2023

The costs of operating trucking companies continued to climb in 2022 and will most likely continue to do so in 2023. Increasing interest rates, volatile fuel prices, and a high employment rate are all creating upward pressure on costs, and we can expect to see this continue through 2023 and possibly for several years.

Along with rising interest rates, the cost of loans will continue to increase, which will cause monthly payments to rise on loans. Banks will also begin to tighten their lending standards, making it harder for truckers to obtain business lines of credit or loans for their businesses.

Savvy trucking companies will begin looking for financial experts to employ who can help hedge against the rising cost of fuel and other expenses by trading in futures like airlines and the food industry have been doing for years.

Third party investors like private equity investors, trust funds, pension fund managers, hedge funds, venture capitalists, and wealthy individual investors have entered the market to fill in gaps providing financing to trucking companies as well as other types of businesses. They have found the traditional routes of stock and bond trading lack luster and have soured on increasing risk from volatility. Because of this, they are searching out opportunities to make direct loans or equity investments to businesses themselves rather than buying stocks and bonds. This provides savvy business owners the opportunity to take advantage of these third party financiers to help grow their trucking companies and manage cash flow.

Factoring for Truckers by third party finance companies like Balanced Bridge Funding is a great way to help trucking companies manage their cash flow by getting paid faster on their outstanding invoices. Remember, as long as you have funds available to pay for fuel and employees, you stay in business. Using third party finance companies to factor your trucking invoices is a great way to help get your money faster. Remember – lost time is lost money.

About Factoring for Trucking Companies with Balanced Bridge Funding

Does Balanced Bridge Funding Offer Recourse and Non-Recourse Factoring?

Balanced Bridge Funding does not offer non-recourse factoring for trucking companies. We only offer Recourse Factoring for Trucking Companies.

How to Begin Factoring for Trucking Companies

To get started using our factoring for trucking products, we will need to receive a copy of your application, business formation documents, proof of operating authority, and the insurance owner’s driver’s license. Once we receive these documents and you pass a clean public background search, we are able to factor trucking companies’ receivables for you.

Ongoing Factoring for Trucking Companies

Once you have worked with us on your first advance, things become even easier (and faster) for you. For each request for trucking factoring, we will need all relevant documents for the completed job, this can include, a rate confirmation sheet, invoice, dump tickets, etc.

Fast Approval for Factoring for Truckers

Approval of each request occurs in hours and the funds will be wired directly into the account via ACH or wire transfer (for an additional fee).

What Percentage of an Invoice will Balanced Bridge Factor for Trucking Companies?

We will purchase up to 99% of the value of the invoice.

How Does Balanced Bridge Handle Repayment of Factoring for Truckers?

For repayment, we can either submit the invoice ourselves for payment or you can remain the main contact, and then we will automatically pull the repayment amount directly from your account when the invoice has been paid.

Quick Summary of Steps to Begin Factoring for Trucking Companies with Balanced Bridge Funding

- Submit application and entity documents to get company approval – usually completed within 1-2 days

- Submit supporting documents for each invoice – receive an approval within hours of receipt

- Funds are wired immediately to the account (if they pay the wire fee) otherwise funds will be deposited directly into the account via ACH within a couple of days

- When the invoice has been paid, the repayment amount will be pulled directly from the account via ACH or sent directly to us

Balanced Bridge Funding – Trucking Factoring Rates

We do not publish our Trucking Factoring Rates online and we hope you will understand. The market changes dynamically in the transportation industry, and our rates change with it. But you can rest assured that Balanced Bridge Funding is always competitive and offers great rates for your Trucking Factoring.

Contact Us Today by phone at 267-457-4540 or click the button below to complete our quick application. Then, receive your funds quickly and efficiently.