Contract Advances for NFL Players Athletes – Helping NFL Players Manage Cash Flow

Introduction

Contract Advances for NFL Players is a great way for NFL players to finance the off season, make major purchases, finance business deals, travel, and pay for living expenses.

Athlete funding is a topic that is often misunderstood. Many people think that professional athletes have so much money they never have to use loans or any other type f financial vehicle for the rest of their lives. However, this could not be further from the truth. Not only do many NFL players not have all of the money they could ever need, but some also struggle to make ends meet during the off season and regular season as well.

That’s where Athlete Funding vehicles like a contract advance come in.

In this blog post, we will cover the topics of contract advances for NFL players, loans for NFL players, and Athlete Funding in general. When you finish reading, you will understand how contract advances work, how loans for NFL players work, why professional athletes from draftees to veterans make use of athlete funding, and the various ways we have seen NFL players make use of athlete funding to help finance their lives and businesses.

What is Athlete Funding?

Athlete funding is the term used to describe various financial vehicles professional athletes use to finance homes, businesses, travel, and living expenses.

What is a Contract Advance for NFL Players?

There are many types of athlete funding, but one of the most common is called a contract advance. A contract advance is when an athlete takes out an advance on the money they are owed from their future contract. Typically, this happens through a private lending company that uses the NFL Player’s pending contract as collateral for a loan so the athlete can get some of their money now. Then, once the athlete gets paid from their contract, they repay the lender.

Loans for NFL Players

Loans for NFL Players is another financial vehicle that falls under the banner of Athlete Funding. Loans for professional athletes are becoming more and more common. There are a few reasons for this. First, the average career length of an NFL player is only three and a half years. This means that many players don’t have the time to build up enough savings to cover their expenses during the season. Second, the NFL has a salary cap that limits how much teams can spend on player salaries. This means that many players are underpaid relative to their worth. As a result, many players take out loans to make ends meet. Third, as financial institutions and private lenders have become more sophisticated, they are looking for opportunities to loan funds to clients outside of just consumer credit cards, auto loans, and home mortgages. They have also adjusted their lending standards to accommodate wage earners who fall well outside of the traditional nine to five job market. This might seem strange, but there was a time when professional athletes could have tens of millions of dollars coming to them in just a few months, and traditional financial institutions wouldn’t even approve them for a used car loan.

NFL Contract Advances

A contract advance is when an athlete gets a loan from a private lender in order to cover their expenses. Athlete funding has become a popular way for NFL players to get the money they need to cover their costs while they are playing. Loans for athletes can be used for many different purposes, including covering living expenses, travel costs, training expenses, and more.

How NFL Players Get Paid

To understand why athlete funding is important, you first have to understand how NFL Players are paid. NFL players are some of the highest-paid athletes in the world. They make millions of dollars each year playing a game that they love. But the way they are paid is complicated. Very few people understand it. Players themselves often struggle to understand how they get paid.

Players are typically paid a salary by their team. This salary can vary depending on the player’s position and experience. For example, quarterbacks typically make more money than linemen. Salaries also vary depending on how good a player is, what their expectation is, whether they start or now, and more.

But that is just part of it. NFL Players are paid to attend various practices during the off season. They receive signing bonuses. They get paid less for pre-season games than they do for regular season games. They receive their full salary for regular season games and receive more for playoff games and even more if they make it to the super bowl. There are also bonuses for winning games and all kinds of events that can happen during a game or season.

About The NFL Salary Cap – NFL Teams Can’t Spend Anything They Want on Players

One factor that helps determine how much any one NFL player is paid by their team is the NFL Salary Cap. The NFL has a salary cap limits how much each team can spend (in total) on their players each year. The salary cap is set at a certain amount each year and teams cannot exceed this amount. The salary cap helps to keep the league competitive and ensures that no one team has an unfair advantage over the other simply because they have more money to spend on their players.

The salary cap is determined by a number of factors, including league revenue, player costs, and more. The salary cap is set each year by the NFL’s Management Council. The Management Council is made up of representatives from all 32 teams in the NFL.

The salary cap for the 2022 season is $208.2 million per team. This means that each team can spend up to $208.2 million on all of their player’s combined salaries for the year.

Source: https://www.nfl.com/news/building-the-best-nfl-team-money-can-buy-under-the-2022-salary-cap

So, when an NFL team is trying to determine salaries for individual players, they have to make sure they stay under the NFL salary cap, which limits how much any one player can receive. And if you pay attention to the NFL at all, you are aware that an individual player like Patrick Mahomes can receive salaries in the tens of millions (and signing bonuses in the hundreds of millions). This leaves less money to pay the rest of the team and makes sure the team stays below its salary cap.

As you can imagine, this means that although a player like Patrick Mahomes can warrant an annual salary of forty five million dollars, a player on the special teams squad might be making the NFL League minimum salary of $705,000 (as of 2022).

This variance is important to understand because although $705,000 per year probably seems like a lot of money, NFL careers are short, and hard on players bodies. Players often need to travel to the city where their new team is located and might have to relocate their families and even maintain two residences (one near the team training facility and one where they are from).

Financing The Off-Season for NFL Players

Now that you know a little about how NFL players are paid, the next thing you need to know is that most professional athletes do not get paid a regular paycheck all year round. This is the case with NFL players. During the off-season, NFL Players do not receive any checks. And then during pre-season, they do not get their full salaries either. Because of this, some NFL Players end up using credit cards or loans to finance their living expenses during the off season.

This can be a real challenge because credit cards often have low credit caps, high interest rates, fees, and offer insufficient capital for buying a home or purchasing businesses. Plus, the amount of credit you qualify for when you get a credit card is often limited by your credit score and how much money you already owe other creditors. Credit cards are particularly hard to get for rookies who may not have established much credit yet, and don’t have three years’ worth of tax returns to justify being approved by a credit card company.

Even though a player may have millions of dollars coming to them in just a few months, until they receive their money, they basically have to wait to buy the things they want.

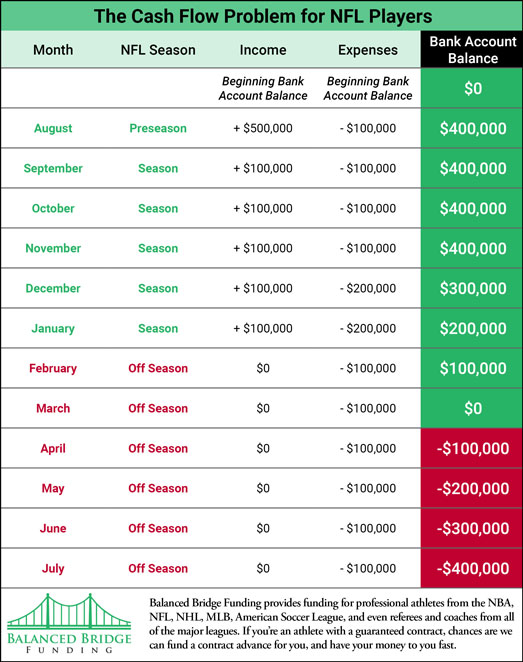

The Cash Flow Problem for NFL Players Infographic

People With Regular Jobs Don’t Wait – Why Would an NFL Player Be Any Different?

Very few people will ever know what it is like to be a professional athlete who has a great deal of money coming to them very soon but can’t get access to it to buy a car, a house, travel, or invest in a business opportunity. But if you are a professional athlete, you know all about this.

It can be frustrating to know you’ve got millions of dollars coming to you, but until you get it, you are missing out on opportunities. If a house comes up for sale you and your family are interested in, you have to wait. If your family needs some money because they are struggling to pay some bills, you can’t help them until you get paid yourself. If there is a new car coming out you really want, you can’t buy it because you don’t get paid during preseason or off season.

This is precisely why contract advances for professional athletes exist – because NFL players are people – and people who have a regular nine to five job don’t wait until they save up the money to buy a car or a home; why would an NFL operate differently? Athlete Funding exists so professional players will be able to access capital to buy homes, and cars, travel or invest in business opportunities. By using a contract advance, you have the ability to get access to some of your money now (for a fee), so you don’t have to miss out on buying the things you want.

Starting Out in the NFL is Expensive

Many athletes don’t live where they play, so they need a home for the off season, a home for the regular season, travel for themselves and family, and all of the expenses that come with living in two locations. So imagine what that is like for an NFL draftee or rookie. Even if they are going to get a huge signing bonus, they don’t normally get all of that money upfront. But they still have to lay out cash for travel, housing, and living expenses.

Also, a lot of NFL draftees want to buy a home for their parents to thank them for supporting them before they turned pro. But again, they already have a great deal of expenses to cover, and a signing bonus from an NFL team is often paid over several years.

These are some of the reasons NFL Draftees use contract advances and other Athlete Funding financial vehicles when they are starting out. It allows them access to some of their money right away to cover these new expenses.

Draftees and rookies can struggle mightily to gain access to money, even when they have tens of millions of dollars on the way. Without established credit or three years of tax returns showing they can pay back the loan, banks may be reluctant to loan money to professional athletes as they don’t always understand their pay schedule.

Off-Season NFL Training is Expensive

Off season training for NFL Athletes has become a big deal over the years. Most professional athletes spend at least some of their off season traveling to different facilities to train on skills, strategy, strength, agility, and more.

Off-season training is a significant investment in the future of the athlete. Strength and stretching training can increase the length of an NFL Player’s career (by reducing injury risk). Skills training can increase an athlete’s value to the team, net them a big signing bonus when their contract is up for negotiation, or make them highly sought after as a free agent.

Plus, among players, there is a great deal of competition for those starting positions. If an athlete’s competition is out-training them because they are investing in new technology, better coaching, nutrition counseling, and better training facilities, they might gain an edge. So if their competition is traveling and spending money on training, an intelligent athlete is going to do the same thing. Specialty coaches, consultants, nutritionists, scientists, equipment, and travel are expensive. And all of this is happening during the off-season while NFL Players are not being paid their salaries, which means, players need additional access to capital to pay for training, but they aren’t getting a regular paycheck. Contract advances and loans for NFL Players are a great way to help cover many of these expenses until regular season play resumes.

Why NFL Players Have Cash Flow Problems

If you think about an NFL Player like a business instead of a person, the cash flow challenges they face make more sense. Many businesses struggle with cash flow for the same reason NFL Players do: Their bills are due every month, but they don’t get paid every month.

Whether you are an entrepreneur, major corporation, or NFL Player, any time you have money “flowing” out of your bank account on a regular basis, and you have money “flowing” into your bank account at irregular times, you are going to have cash flow problems.

But what is cash flow? People in business talk about cash flow a lot, but very few people truly understand what it is, which is unfortunate because it isn’t complicated to understand.

Cash flow is simply the term used to describe the “flow of cash” coming INTO your bank account versus the “flow of cash” going OUT OF your bank account. That is all cash flow means – cash “flowing” in and cash “flowing” out of your bank account.

What are Cash Flow Problems?

Cash flow problems are the only real reason people care at all about cash flow. NFL players have “cash flow problems” because they don’t get paid every week like people who have 9 to 5 jobs. They have money flowing OUT of their bank account constantly (like everyone does) to pay bills, tuition, mortgage, travel, etc., but the money only comes in occasionally (even though it is in massive quantities).

When your money is flowing out quickly and flowing in slowly you tend to have “cash flow problems.” Why? Because the money is “flowing out” faster than it is “flowing in” and if this continues to happen long enough you can run out of money. Even though you have a large sum of money guaranteed to you in the future, when you are out of money, you can’t pay your bills.

When you don’t have any cash in the bank, it doesn’t matter if you have tens of millions of dollars coming to you soon. You need cash to pay for things. You can’t spend your signing bonus until you have it in the bank, no matter how large it is going to be.

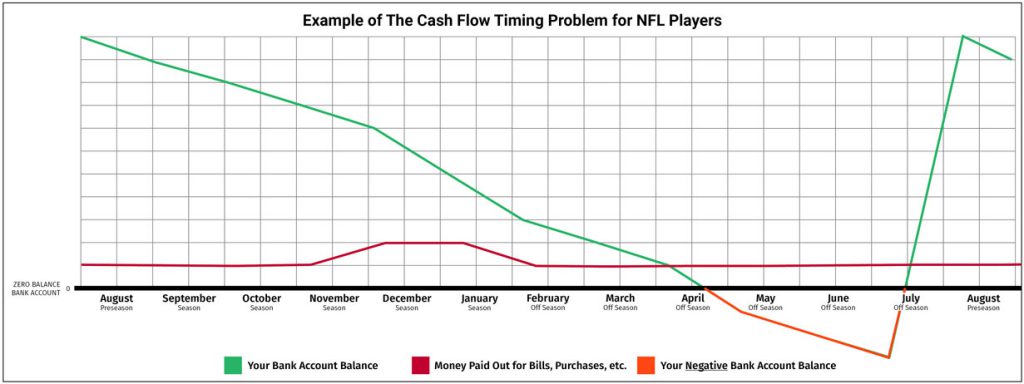

The Cash Flow “Timing Problem”

Cash flow problems for NFL Players are also caused by the “timing” of when they get paid versus the timing of when they have to pay others.

Understanding the Timing Problem – If you get paid three and a half million dollars in August (money flowing in), but you don’t get paid again until the following August, you will watch your money decline for an entire year as you spend money to live on (money flowing out). And if you run out of money before then, or need more money to pay for a large expense, this is referred to as a cash flow problem – it’s a problem because you ran out of money before you got more money in to replace it.

As we mentioned before, this doesn’t just happen to NFL players. Most businesses have this kind of challenge. Lawyers who work on a contingency fee basis may work for years on a case before they get paid. While they are working on the case, their savings are going down the entire time because they still have to pay rent, salaries, expert witnesses, court costs, travel costs, and more. This creates cash flow problems.

In truth, just about every type of business has cash flow struggles created by money going out constantly, and money coming in occasionally. This happens every day in all types of businesses.

Example of The Cash Flow Timing Problem for NFL Players

Money goes out every single month, but money doesn’t come in during the off-season and very little money comes in during pre-season play so cash keeps going down, down down, and then something they want to buy pops up, and even though they have millions coming in “soon” – they still can’t buy the thing they want or take advantage of the opportunity because they don’t have any cash.

What is Cash Flow Management?

Cash flow management is any activity attempting to regulate these two flows of cash (cash flowing in versus cash flowing out). The goal of cash flow management activities is to keep the money flowing into the bank account or slow the flow of money leaving so you don’t run out of money before you get paid again.

Most people tend to think of cash flow management as reducing spending. Cutting costs. But the truth is, most serious businesses don’t spend a lot of their time trying to cut costs. Instead, they work hard to keep the cash coming in. They may do this by borrowing money, selling bonds, selling stock (equity), factoring the money they are owed (selling it early as a discount), or trying to increase sales.

It is important to pay attention to the language we are using here. The point of cash flow management is to get cash in the bank account. It doesn’t matter if you borrowed the cash, sold assets to get it, or took out a loan to get it, the point is, you do what you have to do to keep cash in the bank account so you can pay the bills. It doesn’t matter where that cash comes from – you need it, and you need it in your bank account to cover expenses so you don’t run out of money.

How NFL Players Can Manage Cash Flow

Remember from the last section of this blog post – cash flow management is about getting money in the bank or keeping the money you have so you don’t run out before more money comes in.

Some Methods For Getting Money in the Bank or Keeping it In The Bank Are:

- Contract Advances

- Credit Cards

- Loans

- Stock Dividends

- Savings

- Owning Businesses

- Signing Bonus Advances

Contract Advances for NFL Players

One thing an NFL Player can do to help solve cash flow challenges is to take out a contract advance. A contract advance allows NFL Players access to the money right away. A contract advance allows players to “take an advance” on the money they have coming to them from their NFL contract.

By taking out an advance on your NFL contract, you can get some of your money now to pay for things you want or need. Most athletes take advantage of contract advances. And not just draftees or rookies. Veteran athletes who are waiting for massive signing bonuses often take out partial advances to buy a house, take a trip, buy a car, purchase a business, make an investment, etc.

Contract Advance for NFL Pre-Season

Until the regular season begins, NFL Players will only make a minimal amount of money. During that time, you may need to buy a new home in a new city for you and your family. You will probably have to travel to spring practice and stay there.

You might be just out of college and need a car. You might need to rent an apartment for yourself or your family. It is expensive to relocate to a new city. It is even more expensive if you want to maintain a residence in your hometown and a residence where your team is located, which is a normal thing professional athletes do.

What if I Just Want a Contract Advance to Buy a Cool Car?

A lot of NFL Players take out contract advances to buy a new car. You’ve worked hard to get where you are. Why shouldn’t you have a nice car to drive? Although there are some limitations to what a player can spend their contract advance on, most things like a new car are not going to be an issue. Neither is buying a new car for your parents.

Can I Buy My Parents a House with My Contract Advance?

Of course, you can, and lots of NFL players buy their parents a home or pay off their existing home as a way of showing their appreciation for all the work their parents put in to help them get where they are now. You can buy every member of your family a new home if you want to.

Credit Cards for Managing Cash Flow

NFL Players can use credit cards to help manage their cash flow challenges. By putting all of your normal expenses on your credit card, you keep the cash you have and put your expenses on the card. Then you can pay it off (hopefully) when you start getting paid again during the regular season.

There may be a few challenges with credit cards, however. One, to be approved for a credit card you generally need a pretty good credit score. Two, it is hard to know how much credit you will be granted by credit card companies. If you are planning on using credit cards to help manage cash flow for the entire off season and pre-season, you will need a sizeable credit limit. Otherwise, you can run out of credit and not have the money to pay the monthly minimums until the regular season begins, which will further damage your credit score, and limit your ability to use credit in the future.

Another challenge with credit cards is that they usually have high interest rates, and many have annual fees. If you are only making your minimum monthly payments on your credit cards, it can take more than a decade (in some cases) to get your balance paid off. Plus, if you miss a payment, most credit card companies automatically raise your interest rates even higher, and never bring them back down even when you get back on track.

In addition, and most people do not know this, but credit card companies change their lending standards all the time. And just because you met the credit card companies lending standards when they issued you the credit card, does not mean you will in the future. It is not uncommon for credit card companies to close your account without warning and without explanation. In fact, this often happens right after you pay off the card. You suddenly get a notice that your credit card has been canceled. This happens to people every day. The credit card companies decide they no longer want to loan money at certain amounts or to people who pay off their credit cards quickly and they simply close the account on you.

Bank Loans for Managing Cash Flow

NFL players may be able to get a traditional loan to pay for things like a car or home, but it is harder to get a traditional loan for travel, buying a second (or third) home, a vacation home, or purchasing a business opportunity or for investments.

Banks have very specific lending standards they use to decide if they are going to loan someone money or not. They often ask for two to three years of tax returns as well as bank statements to prove you can repay a loan. For rookie athletes, this can be a challenge. Banks also have credit score requirements. You might not have well-established credit yet if you are a newer team member.

Even as a veteran player, if you have taken out quite a few loans already, banks are less likely to loan you more money past a certain point. They refer to this as your “debt to equity ratio.” The more money you owe other creditors, the less amount of money you will generally be allowed to borrow in the future.

Lastly, bank loans are generally secured loans, meaning they will want collateral to back the loan. This might be real estate, the car you intend to purchase, or stocks and bonds. Banks do not make a lot of unsecured loans. They normally want collateral. And if they do make an unsecured loan, it is normally only to individuals with the best credit scores, and even then, interest rates and fees for unsecured loans are often much higher than loans backed by collateral.

We are not trying to say anything negative about traditional loans or banks. But for managing cash flow for professional athletes during preseason or off season, traditional loans may not be the best or most practical way to go for NFL Players.

Savings for Managing Cash Flow

For the prepared person, using personal savings to manage cash flow may be a reality. You’d maintain enough money in your savings account to get through training camp and the off-season.

Trying to finance your cash flow through savings alone is difficult because it leaves no room for important opportunities that come up. If a fantastic business investment appears, you’ll likely need more money than what’s in your savings to finance the purchase. The same goes for making major purchases, like houses. If you find your dream home on the market, chances are good that your savings won’t cover all of it.

Most businesses finance their cash flow using means other than savings, such as factoring (advances), loans, lines of credit, private equity, and selling stocks or bonds. If you start thinking of yourself as a business rather than just a professional athlete, it will change your perspective on how to finance cash flow. Making financing decisions like a business would be more beneficial for you in the long run.

Buying Businesses to Manage Cash Flow

Many NFL players purchase businesses because they know their NFL Career isn’t going to last forever. They invest their earnings in businesses that will keep them earning enough money in the future that they will be able to maintain their current lifestyle indefinitely. Plus the cash flow from these businesses can help offset not having money coming in during the off-season.

Here are just a few types of businesses professional athletes own:

- Starbucks Franchises

- Five Guys Franchises

- Auto Dealerships (lots of pro athletes own auto dealerships)

- Restaurants (franchises or their own brand like Elway Steakhouses)

Source: https://www.gobankingrates.com/net-worth/sports/athletes-major-business-empires-outside-sports/

And these are just a few of the businesses athletes own. Some athletes have their own television production companies or have founded startups ranging from athletic apparel companies (like Venus and Serena Williams) to vitamin companies (like Tom Brady).

They buy and operate these businesses because of the cash flow that comes from them. They know that someday, they won’t have money coming in from their athletic career any longer. So, they invest the money they receive from playing sports into businesses that will continue paying them long after their career as a professional athlete is over.

You will notice in the source article that lots of big-name players invest in franchises.

Source: https://www.gobankingrates.com/net-worth/sports/athletes-major-business-empires-outside-sports/https://www.gobankingrates.com/net-worth/sports/athletes-major-business-empires-outside-sports/

NFL Players Invest in Franchises

If you don’t have a good mind for business, or just don’t have any experience, investing in a franchise may be a great option for you. Franchisers know precisely what you need to do to operate fifteen, fifty, or five hundred locations without spending every moment of your life managing them. So, if you are new to the business, buying successful franchises is a wise decision for a lot of people. In fact, business statistics show that in their first year, almost half of all businesses fail – EXCEPT – franchises. 96% of franchises are still open after their first year. These are important numbers. Opening a new business is hard. Franchises make it easier because they have already figured out how to succeed. You just have to follow their model.

Franchises Are Expensive – You might be asking yourself, “if franchises are so great, why isn’t everybody doing it?” The answer is most people can’t afford to buy a franchise. A single location franchised restaurant can cost millions (and often do). And most franchise owners won’t let you buy a single location. They want you to open ten to twenty locations within the first few years of ownership. This makes owning a franchise difficult for the average person. But professional athletes who make a lot of money playing their sport, have the buying power to consider purchasing really well-established franchises.

Source: https://www.therichest.com/business/the-top-10-most-expensive-franchises-in-the-world/

NFL Signing Bonus Advances for Managing Cash Flow

If you have an NFL signing bonus coming to you, taking an advance can be a great way to help manage cash flow. Plus, because athlete funding companies like Balanced Bridge Funding know your signing bonus is guaranteed, we are very willing to loan money against it. The way signing bonus advances work is, we purchase a portion of your signing bonus today for a fee, and then when the team pays the signing bonus, the team pays us what we are owed, and they pay you the remainder of what you are owed.

NFL Rookies often use a signing bonus advance to help fund travel for themselves and their families to their new city. Veteran athletes can use them as well to finance business opportunities as they arise and to purchase new homes, or other investments. The old saying goes “opportunity waits for now man.” Taking out an NFL Contract Advance is a great way to make sure you have the funds you need to not miss out on the opportunities that come your way.

Summary Contract Advances for NFL Players

Professional athletes are not paid during the off-season and do not get full payment before the season begins. They still have to pay bills, care for their children, travel, train, and a mortgage (and sometimes two mortgages). Professional players must either “go without” or wait until they are compensated during the regular season if they don’t use some form of financing mechanism to assist them.

Many professional athletes have cash flow problems because they receive money at irregular intervals, but their expenses are continuous. If you have constant outgoing payments and only occasional incoming ones, you’re going to experience cashflow difficulties – even if the income is high when it does come in.

When you don’t have a consistent income, it’s easy to miss out on chances to make more money. If a great opportunity for investment or business comes up, but you can’t access your savings, then you’ve already lost before you’ve even started. The same goes for housing opportunities; if the perfect home is available close to where you train, but you lack the funds necessary for collateral or down payment misses that chance as well – no matter how much future earnings are promised.

Not every professional athlete is in a position to take out a loan or line of credit. Banks keep an eye on credit scores, demand security, and have stringent lending criteria that are not always useful for professional athletes. This is especially true for draftees or newcomers – banks frequently demand three years’ worth of tax returns to validate your earnings, and you may not have any to report if you’re a draftee or rookie.

Some athletes use credit cards to finance the preseason and off-season. However, credit card interest rates and charges are often exorbitant. Furthermore, you may not have a credit limit sufficient to take advantage of everything you want to buy. Most credit cards with large limits, like certain American Express Cards, do not allow you to carry a rolling balance, forcing you to pay them off by the end of each month.

Many athletes purchase businesses, and franchises, in particular, to keep money coming in after their career ends. Business loans can be difficult to obtain, but with a contract advance, you can get the funding you need right away.

Using an NFL Contract advance or NFL Signing Bonus Advance is a great way to get some of your money right away to buy the things you want, finance the off-season (and pre-season), and take advantage of business or investment opportunities as they arise. Very few people will ever know what it is like to have millions of dollars coming to you and still not be able to buy a home or car because you simply do not meet the lending standards of old-school financial institutions. But at Balanced Bridge Funding, Athlete Funding, including NFL Contract Advances and NFL Signing Bonus Advances are one of our specialties. We have been working with athletes for years and we understand how their pay works and how frustrating it can be to not be able to gain access to funds to buy the things you want. We know athletes, and we are here to help.

More Details about NFL Contract Advances from Balanced Bridge Funding

How Much Money Can I Borrow Against My Contract?

If you work with Balanced Bridge Funding, we can generally fund up to five million dollars against your contract – or – as little as $25,000. A lot of this depends on the size of your contract, and how much of a contract advance you can take out.

How Long Does It Take To Get Approved For an NFL Contract Advance Loan?

This is the best part. You can be approved and have your money from a contract advance in a matter of days. You simply provide the documentation we need, sign your agreement, and we send you the money right away. It is easier than you can imagine.

Is An NFL Contract Advance an Actual Loan?

Yes, an athlete’s contract advance is a loan; funded by a finance company like Balanced Bridge Funding instead of a bank. But it is still a loan.

Why Wouldn’t I Just Borrow the Money from a Bank Instead of Using a Contract Advance?

One of the reasons you might work with an athlete funding company like Balanced Bridge Funding is because we have different lending standards than banks as far as professional athletes go. We work with athletes, so we know how the payment system works and we see future athlete earnings as great collateral. It isn’t that we are any different from a bank – we just have different lending standards that are favorable to professional athletes.

Is Balanced Bridge Funding just a “Middle Man” or a Broker?

No, Balanced Bridge Funding is a direct lender. We are not a broker for some other company that loans the money. This is important because if there are any issues with your loan approval or after the loan is made, you are dealing directly with the source of your loan instead of a broker who has no real say in any part of the process.

How does a Contract Advance Work?

A contract advance is simple. You send us some paperwork showing the value of your upcoming contract, we negotiate how much of a contract advance you want to take out, we agree on fees and conditions, you sign our agreement and within a few days you will have the cash in your bank account.

Just Click the Apply to Get Started button below.

How Does Balanced Bridge Funding Make Money on NFL Contract Advances?

We get paid much the same way as any financial institution, and for the same reasons. We essentially get paid to “wait for the money.” You get your money now, and for a fee (often referred to as interest), we wait to be paid from your contract sometime in the future.

The fees vary a great deal depending on the size of the advance, the length of time we must wait to receive our funds back from your contract, and other factors. We do not publish our fees online, as they change often with the market. If you call us, we can tell you what your fees will be today.

To Apply for a Contract Advance – Click Here

Case Study: Buying a New House with Contract Advance

The Request

We received a request to secure real estate financing on a $5.3 million home for an NBA Player who had just signed a $40 million contract.

The Challenge

The Player, with limited credit history, limited cash reserves relative to the purchase price, and insufficient tax returns to satisfy the mortgage underwriting requirements, had to put a significant amount of money down to qualify for the mortgage; but they were not going to receive their money for several months (until camp started up).

What We Did

We were able to provide this client with a contract advance for 104% of the purchase price to include all closing costs and fees.

The client ultimately saved 8% by doing a cash purchase of the home. The Player was not required to use his own funds for a down payment, and he closed on the home loan in 7 days.

About Balanced Bridge Funding

Balanced Bridge Funding provides funding for professional athletes from the NBA, NFL, NHL, MLB, American Soccer League, and even referees and coaches from all of the major leagues. If you are an athlete with a guaranteed contract, chances are we can fund a contract advance for you, and have your money to you quickly.