Class Action Settlement Advances for Plaintiffs – Settlement Funding for Plaintiffs

Class Action Settlement Advances for Plaintiffs – Settlement Advances for Plaintiffs helps reduce the time it takes to receive some of your money from a class action lawsuit settlement.

It takes a long time for most class action lawsuits to reach their conclusion, and when they do, you might expect to receive your money quickly, but this is rarely the case. It can take up to two years (and sometimes much longer) for the defendant to pay everyone involved.

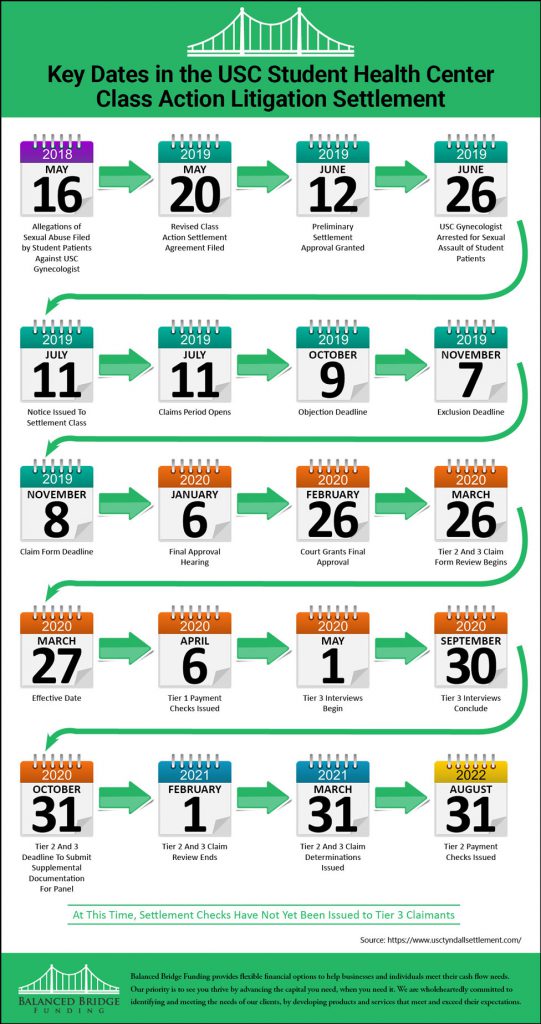

In the spring of 2021 USC (University of Southern California) was ordered to pay a massive award to victims who were sexually assaulted by one of their employees, but it took nearly six months for the first group of people to receive their money, and a second group had to wait eighteen months (August 2022) to receive their payment from this landmark class action lawsuit.

Key Dates in the USC Student Health Center Class Action Litigation Settlement

Historically there wasn’t much you could do about the waiting period. You just had to wait. But not anymore. Now you can get some of your money right away using a financial vehicle called Settlement Advance for Class Action Lawsuits.

When you are owed settlement money from a class action lawsuit, the money you are owed is considered an asset, like a stock or bond. And just like a stock or bond, you have the right to sell that asset to someone else for an agreed upon price any time you feel like selling it. This arrangement in the legal industry is commonly known as a settlement advance, post settlement advance, settlement loan, settlement funding, lawsuit loans, and other names.

The rest of this article will explain how settlement advances for class action plaintiffs work, what you can use your settlement advance for, and some other details we think you should be aware of regarding settlement advances for plaintiffs.

Is it Difficult to Get a Settlement Advance?

Taking out a settlement advance is easy. It isn’t a loan, so it isn’t dependent on your credit score. This is one of the benefits of working with a professional Legal Funding Company – we know what needs to be done and we do most of the work for you. You fill out the application and we do the rest. You don’t even have to pay the money back yourself. Legal funding companies get their money directly from the settlement attorney of record once they start paying everyone from the lawsuit. Getting a settlement advance might be one of the easiest things you do while dealing with a class action lawsuit.

What do Plaintiffs Use Settlement Advances For?

Most of the time, plaintiffs use their settlement advance to help pay bills. Some people use their settlement advance money to relocate. Others use their settlement funding to back to school and learn new skills. Some people use their settlement advance to buy a home, car or take a trip. Unlike a loan, a settlement advance is your money. If you sold some stock, the proceeds from that sale are yours to do whatever you want to do with the money – a settlement advance is no different. It’s your money and you can do what you want with it.

How Does Settlement Funding Work?

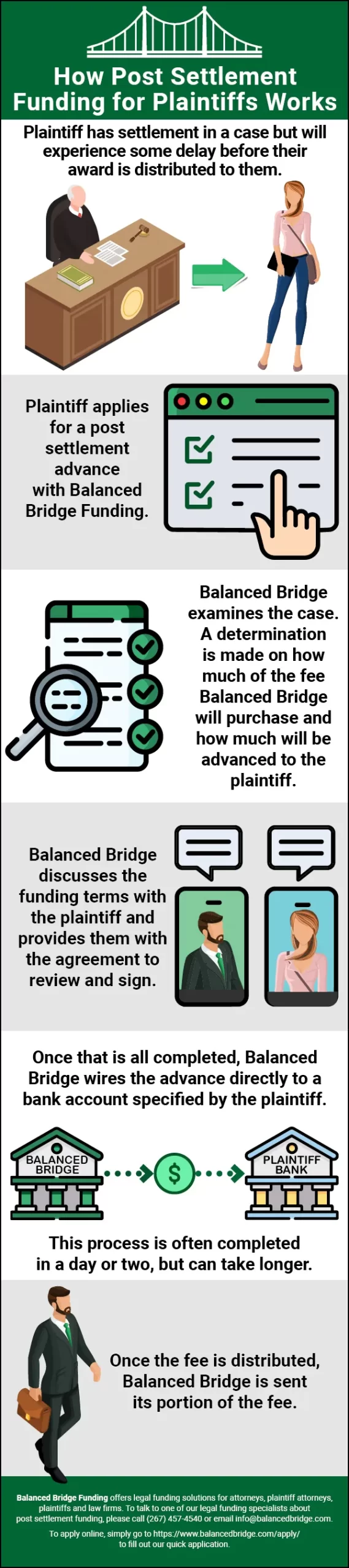

Infographic – How Settlement Funding for Plaintiffs Works

Let us explain how a settlement advance works.

- Plaintiff has settlement in a case but will experience some delay before their award is distributed to them.

- Plaintiff applies for a settlement advance with Balanced Bridge Funding.

- Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the plaintiff

- Balanced Bridge discusses the funding terms with the plaintiff and provides them with the agreement to review and sign.

- Once that is completed, Balanced Bridge wires the advance directly to a bank account specified by the plaintiff

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Is Settlement Funding for Class Action Plaintiffs A Loan?

A settlement advance for class action lawsuits is not a loan. When you receive a settlement advance, the legal funding company does not loan you money. The money you are owed from a class action lawsuit is considered an asset (like a stock or bond). And just like any other asset you own (like a stock, bond, or your car or house); you can sell it to someone else for an agreed price.

Using the example from the infographic above, this person agreed to sell $50,000 of their class action lawsuit settlement for the price of $45,000. The settlement advance company now OWNS the right to $50,000 of the class action lawsuit settlement and will receive their money directly from the settlement. They bought the asset from you for $45,000 and will receive $50,000 from the settlement attorney of record when the settlement is paid, earning the legal funding company $5,000.

Who Pays the Settlement Advance Company Back?

Remember, this isn’t a loan. As a settlement advance company, we purchase the asset from you, and then we own it. You do not have to pay us back; instead, we notify the attorney of record of our ownership of a portion of your settlement award, and when the class action lawsuit settlement pays out, the attorney of record will pay us directly. There is nothing for you to do.

How Much of My Class Action Lawsuit Settlement Can I Sell to Receive an Advance?

The answer is – it depends. In most cases, you will be able to sell about 50% of your class action lawsuit settlement. But you will not normally be able to sell 100% of it.

Is There a Minimum Amount of Class Action Lawsuit Advance I Must Take Out?

At Balanced Bridge Funding the minimum we are generally willing to advance someone is $10,000. And because we can only advance 50% of the total amount owed to you, you must have at least $20,000 (total) coming to you from your lawsuit to qualify for a class action lawsuit settlement advance.

Do I have to pay taxes on my class action lawsuit settlement?

We cannot answer this question for you as an individual, but many types of settlements you receive are considered income by the IRS and are 100% taxable. This is not always the case, however. There are types of settlements that could be exempt from taxation. You should consult with your attorney and CPA to make sure you pay your taxes properly on any settlement money you receive.

Do I have to pay taxes on my post settlement funding advance?

Again, we cannot give you any advice personally, but generally, yes, you will. You are selling an asset, and when you sell an asset of any kind, whether it is a stock, bond, or home, you can expect to pay taxes on all, or a portion, of the amount of the sale. You should consult with your attorney and/or CPA to understand the tax consequences of selling your lawsuit settlement to a lawsuit financing company like Balanced Bridge Funding.

Can’t I Just Get a Settlement Advance From My Lawyer?

No, you can’t. Lawyers are not allowed to loan money to their clients. This is an ethical violation on their part. Plus, judges are constantly watching to make sure this sort of scenario does not happen. Loaning money to clients might have undue influence on the Plaintiff Attorney and the way they present and handle the case for their clients; judges watch for this sort of thing carefully. This is one of the reasons third party legal finance companies exist because your lawyer is not allowed to loan you money or purchase part of your settlement, even if it would help you out a great deal.

Don’t Create Unnecessary Delays Receiving Your Settlement Award

We included the following information to help make sure that you as a plaintiff do not accidentally delay receiving the remainder of your funds. Even if you sell a significant amount of your pending settlement award to take out a settlement advance, you will still have some money owed to you from the settlement. Make sure you do not create situations where your final settlement check will be delayed. You will have to wait as it is. So don’t make the wait longer than it must be.

Update Your Contact Information

One thing we encourage you to do is make certain that if you are involved in a class action lawsuit, the attorney of record has your updated contact information. Class action lawsuits can drag on for years, and you might forget you were involved in it. During that time, you might relocate, change phone numbers, or change bank accounts. If the attorney of record must find you, contact you, and verify that it is you, all of this takes time and causes delays.

Update Your Bank Account Information

Many class action lawsuits distribute funds by depositing the funds directly into your bank account. If you change bank accounts, which people do all the time, make sure you update the attorney of record, or it might take them a long time to locate you and for you to receive your money.

Sign All The Release Forms

Release forms not being signed is another way your funds might be delayed. Technology is helping a great deal with this, as you can often sign your release form online as part of the process of being admitted to the class. But most companies are not going to pay you until your release form is signed, so make certain that it is.

The bottom line is – don’t make it hard for the attorney of record to find you. As of March 2021, $700 million dollars of funds were turned over to the treasurer of the State of Louisiana from the BP Oil Spill Lawsuit – this is money that people are owed, who probably didn’t update their contact information and couldn’t be found by the attorney of record in the case and the money is just sitting there waiting to be claimed. One person is owed $68,000 in that case, but they don’t know how to contact them so the money is just sitting in the state treasury waiting to be claimed.

About a Settlement Advance From Balanced Bridge Funding

Does Balanced Bridge Funding offer Pre-Settlement Funding as well as Post Settlement Funding?

Balanced Bridge does not offer pre-settlement funding solutions for plaintiffs at this time. We do offer post settlement funding; meaning, once your class action lawsuit has settled or concluded, and you are owed a settlement, we can offer you a settlement advance (if you qualify). But no, we do not offer pre-settlement funding options at this time.

A Class Action Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Class Action Lawsuit funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle Free Application

In most cases, we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

Class Action Lawsuit Funding for Plaintiffs

If you think our settlement funding solution could be the right fit for you, please call one of our legal funding specialists at 267-457-4540 or to apply online, simply CLICK HERE and fill out our quick form application.