Attorney Funding – Legal Financing Solutions for Attorneys

About Attorney Funding From Balanced Bridge Funding

Attorney Funding – When you need money to expand your firm, launch a new marketing campaign, or take on new clients, you need it right away. Lost time equals missed opportunities. At Balanced Bridge Funding, we offer you a range of customized attorney funding solutions that are fast, professional, and discreet.

What is Attorney Funding?

Attorney funding is also known as legal finance, third party litigation funding, and legal funding. These are just a few of the different types of attorney funding options available to lawyers. There are also voucher funding, attorney lines of credit, loans for lawyers, and more.

If you’d like to take an in depth look at attorney funding, please check out our Complete Guide to Attorney Funding.

Why Use Attorney Funding?

Lawyers make use of attorney funding for many different reasons but there are three reasons we hear repeatedly from our customers at Balanced Bridge Funding:

- Lawyers need attorney funding to take on new clients

- Lawyers need attorney funding to grow their law firm

- Lawyers need attorney funding to help manage cash flow

Let’s Take A More In Depth Look at These Three Reasons

#1: Attorney Funding to Take on New Clients

For lawyers, taking on new clients and new cases is expensive and time consuming. Even when a plaintiff attorney wins a case, it might take a long time before a law firm gets paid for their work. This can make law firm partners hesitant to take on new clients or certain types of cases because they know it is going to create a cash flow problem for the firm. But if you have attorney funding available to use, it makes it easier to take on more cases, more complex cases, and larger cases.

#2: Attorney Funding to Grow Your Law Firm

Big businesses never hesitate to use “other people’s money” to finance their growth. They sell stock, sell bonds, take out loans, seek out private equity, use lines of credit, and more to finance their future growth. Why should a law firm be any different? If you finance your future growth on your own limited resources, you have limited power and strength to grow your law firm. But if you use finance companies to fund your law firm growth, you have potentially unlimited strength. That is why they call using other people’s money “leverage.”

#3: Attorney Funding to Managing Cash Flow

Cash flow refers to two flows of cash: Cash Flowing into your business – and – Cash Flowing out of your business. If your cash flows out of your law firm faster than it flows in, you will have cash flow problems. Additionally, when you have to continuously pay bills, rent, and salaries every month, but it takes you years to get paid for your work, this creates cash flow problems. Your cash goes down, down, down, and only periodically goes way up. And if you run out of cash to pay those monthly bills, regardless of how much money you have coming to you, you are out of the game. You can’t pay bills with the money you are owed. You can only pay bills with the money you have available now. This is how Attorney Funding came about – to aid law firms in overcoming these cash flow problems.

If you’d like to take an in-depth look at cash flow for law firms please read our blog post Cash Flow 101 for Law Firms.

How Does Attorney Funding Work?

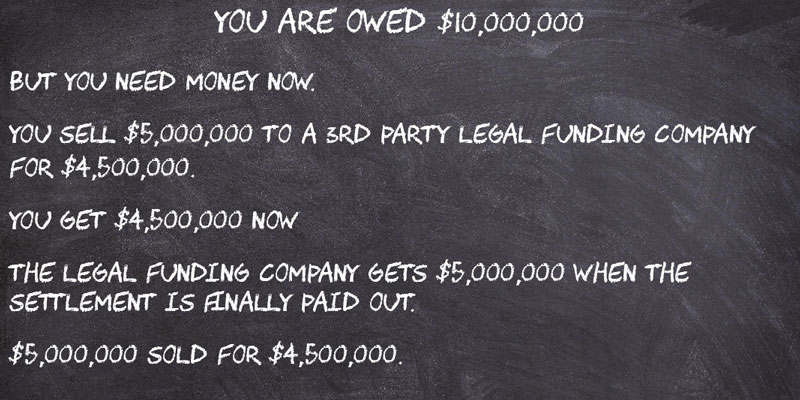

Here is an example of how attorney Funding Works*:

You are owed ten million dollars in contingency fees from a case that has concluded. You sell five million dollars of that money to an Attorney Funding Company for four million five hundred dollars. You get four million five hundred thousand dollars now, and the Attorney Funding Company gets five million later when the attorney of record finally distributes the funds.

The best part is, there isn’t anything more for you to do. The attorney funding company owns the asset and files a claim with the attorney of record, putting them on notice that they own their portion of the settlement award, and when the defendant finally pays, the attorney funding company is paid directly by the attorney of record.

*Please note – the previous example does not in any way depict an actual or fictitious example of a legal funding transaction. Fees change often. This example is strictly for explaining how a attorney funding transaction might work.

More About Attorney Funding From Balanced Bridge Funding

Does Balanced Bridge Funding offer Pre-Settlement Funding as well as Post Settlement Funding options for Attorney Funding?

Balanced Bridge does not offer pre-settlement funding solutions for Attorneys at this time. We do offer post settlement funding; meaning, once your case has settled or concluded, and you are owed a settlement, we can offer you a settlement advance (if you qualify). But no, we do not offer pre-settlement funding options at this time.

Non-Recourse Versus Recourse Transactions

Some types of legal funding are considered non-recourse. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason. Post Settlement Advances fall into this non-recourse transaction category. But, loans for attorneys and lines of credit for attorneys are not non-recourse transactions. Check with your attorney funding professional for each type of legal financing option you are using to determine if it is recourse or non-recourse.

Fast, Hassle Free Application

In most cases, for post settlement funding advances we can get your money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

For attorney lines of credit and loans for attorneys, it may take a little longer as there is additional paperwork involved, but we do everything we can to expedite these applications as well.

If you think Attorney Funding could be the right fit for you or want to explore various Attorney Funding options for your law firm, please call one of our Attorney funding specialists at 267-457-4540. Or to apply online, simply CLICK HERE or the Apply Now button below to fill out our brief application.

Attorney Funding Solutions from Balanced Bridge Funding

Attorney Post Settlement Funding

Post Settlement Funding for Attorneys – It can take a long time for a case to work its way through the court system, and during that time, Plaintiff Attorneys’ bills are piling up. Even once a case settles or concludes, it can still take months or even years for the defendant to pay. This waiting time creates cash flow problems for attorneys.

But you don’t have to wait. Once a case concludes, and you are owed your contingency fees, you are probably eligible for post settlement funding for attorneys from Balanced Bridge Funding. Our application is quick and easy, allowing you access to some of your money right away to pay bills, conduct ongoing marketing, and finance other cases that are still being litigated.

Learn More About Post Settlement Funding for Attorneys.

Law Firm Line of Credit

Having access to an attorney line of credit can help attorneys manage cash flow while they are waiting to be paid for work they’ve already performed. Balanced Bridge Funding offers an attorney line of credit for contingency fee law firms and solo practitioners. Balanced Bridge Funding offers an attorney line of credit for contingency fee law firms and solo practitioners.

Here’s how a line of credit works:

- Balanced Bridge Funding will evaluate your case inventory, which we accept as collateral.

- Some portion of your case inventory needs to be settled cases so there is a defined cash flow.

- Based on that case inventory, Balanced Bridge Funding will issue a law firm line of credit.

- You can withdraw from this line of credit on a monthly basis to finance any aspect of your legal practice.

- Discuss a repayment schedule with one of our legal finance experts.

- As long as you have sufficient collateral, you can extend your line of credit at any time!

Learn More About a Law Firm Line of Credit.

Attorney Voucher Funding

State appointed attorneys are subject to government spending deficits, meaning that payments might get delayed in financial crises. With our voucher funding solution, state appointed attorneys can get their money when they need it.

Advances to Private Practice Attorneys Waiting on Payment from the Local, State, and Federal Government Vouchers for Indigent Clients

The burden of representing an indigent client in court can present a variety of problems to private practice attorneys. Cases and clients can be very difficult. In addition, the fee attorneys can expect to generate from the case will likely be far less than what they usually are paid.

In cases where the client is indigent, they are usually assigned a public defender. It is their job to represent their client to the best of their ability. However, the public defenders’ offices are usually underfunded and overworked. So, they are often unable to devote a huge amount of time and resources to a single case. Due to this reality, private attorneys are called upon to help indigent clients and are compensated by the local, state, or federal government.

Learn More About a Law Firm Voucher Funding.

First Year Attorney Funding

New lawyers can access up to 20% of their first year’s salary with our brand new first year funding program.

Learn More About First Year Funding.

Financing for Social Security Disability Insurance (SSDI) Attorneys

Attorneys working to assist clients with their Social Security Disability Insurance (SSDI) appeals of denied claims can often wait weeks or months for distribution of their fees. With advances from Balanced Bridge, SSDI attorneys will have readily available funds if they can’t afford to wait.

Learn More about Attorney Financing for Social Security Disability Insurance Claim.

Funding on Attorney Fees from Veterans Disability Compensation Cases

Attorneys helping clients appeal denials from the VA for disability claims can also wait for distribution of their contingency fees if those appeals are successful. Our advances will help attorneys in these cases dealing with cash flow crunches as they wait.

Learn more about Attorney Funding from Veterans Disability Compensation Cases.

Apply for Attorney Funding With Balanced Bridge Funding by Clicking the APPLY NOW button.

Or call us to talk to one of our Attorney Funding Specialists: (267) 457-4540