About Factoring For Trucking Companies – How Trucking Companies Use Factoring

About Factoring for Trucking Companies – Trucking companies use factoring to receive payments for their services sooner than they would if they were to wait on payment from their clients. This can be beneficial for trucking companies because it helps with cash flow, as well as growth.

There are a few different ways that trucking companies can factor their invoices. The most common way is to sell their invoices to a factoring company at a discount. This means that the trucking company will receive less money than they are owed, but they will get the money much sooner. This can be a good option for trucking companies that need quick cash.

Another way that trucking companies can factor their invoices is by taking out a loan against their invoices. This means that the trucking company will still be owed the full amount of their invoices, but they will have to pay back the loan plus interest. This can be a good option for trucking companies that have good credit and need a large sum of money quickly.

Factoring can be a helpful tool for trucking companies. It can help them continue growing their business, buy more trucks, hire more drivers, and maintain cash flow. If you are a trucking company in need of quick cash, consider factoring your invoices. Factoring Companies or a freight factoring company buys receivables (invoices) right away, which helps trucking business get money in the bank. The Factoring Companies make money by charging fees for “advancing” money now, and waiting to get paid once the client pays.

What is Factoring?

Factoring is a type of financing that allows businesses to sell their accounts receivable (invoices) to a Factoring Company at a discount. This provides the business with an immediate infusion of cash, which can be used for Working Capital, expansion, or other purposes. Factoring is not a loan, so there is no debt incurred and no monthly payments to make. Factoring is also not a form of equity financing, so there is no loss of ownership or control of the business. Factoring Companies are usually willing to factor invoices from businesses with good credit, but they will also consider businesses with less than perfect credit.

There are two types of Factoring: Recourse and Non-Recourse. Recourse Factoring is the more traditional type of Factoring, and it is the type that is most often used by businesses. With Recourse Factoring, the Factoring Company takes on the credit risk of the customer, which means that if the customer does not pay the invoice, the Factor is responsible for paying the bill. Non-Recourse Factoring is a newer type of Factoring used by Factoring Companies, and it is becoming more popular with businesses. With Non-Recourse Factoring, the Factor does not take on the credit risk of the customer, which means that if the customer does not pay the invoice, the business is responsible for paying the bill. But, because of the increased risk to the factoring company for non-payment, their fees are often substantially higher. More risk equals more reward, in the form of fees in this case.

Factoring for Trucking Companies Frequently Asked Questions FAQ Infographic

Factoring can be a helpful tool for businesses, especially trucking company businesses who have to do work up front and incur costs, but don’t get paid until later.

Five Important Questions About Factoring for Truckers

- What is factoring?

- How can trucking companies benefit from factoring?

- What are the different ways that trucking companies can factor their invoices?

- When should trucking companies factor their invoices?

- How can trucking companies get started with factoring?

#1: What is Factoring?

Factoring is the process of selling invoices to a third party at a discount in order to receive immediate cash. This can be beneficial for trucking companies because it allows them to get paid immediately, rather than waiting 30, 60, or 90 days for their invoices to be paid. Factoring can also help trucking companies improve their cash flow and free up working capital.

#2: How can trucking companies benefit from factoring?

There are many benefits that trucking companies can gain from invoice factoring. The most obvious benefit is that it allows them to get paid immediately, rather than waiting for their customers to pay their invoices. This can help improve cash flow and make it easier to cover expenses and make payroll. Factoring can also help trucking companies free up working capital, as they will no longer need to tie up cash in receivables.

#3: What are the different ways that trucking companies can factor their invoices?

There are two main ways that trucking companies can factor their invoices: recourse and non-recourse. Recourse factoring means that the trucking company is responsible for collecting payment from their customer if they do not pay their invoice. Non-recourse factoring means that the factor takes on the responsibility for collecting payment from the customer.

#4: When should trucking companies factor their invoices?

Trucking companies should factor their invoices to avoid struggling with cash flow problems that inhibit growth and threaten the ongoing existence of the company. Most trucking companies can benefit from factoring their receivables. Even if a company has a decent line of credit, there are often limits to how high a line of credit can go – which can inhibit your growth and create an aversion to risk.

#5: How can trucking companies get started with factoring?

There are many different ways that trucking companies can get started with invoice factoring. There are many factorings companies that specialize in working with trucking companies. These companies can help trucking companies set up an account and start funding their invoices.

Five Reasons Trucking Companies Should Use Factoring

- Factoring can help trucking companies to maintain cash flow.

- Factoring can help trucking companies to keep their trucks running.

- Factoring can help trucking companies to handle unexpected expenses.

- Factoring can help trucking companies to take on new clients.

- Factoring can help trucking companies to grow their business.

Factoring Can Help Trucking Company’s Maintain Cash Flow

The Basic Cash Flow Problem for Truckers

It is expensive to run a trucking company. Operating expenses for trucking companies can include fuel, maintenance, tires, insurance, licenses and permits, and driver pay. Fuel is usually the largest operating expense for a trucking company. The price of diesel fuel has a major impact on trucking company operating costs. Maintenance costs can include scheduled repairs, preventive maintenance, and roadside assistance. Tires are a significant operating expense for trucking companies, as they must be regularly replaced due to the wear and tear of driving on the road. Insurance is another important operating expense, as it protects the company’s drivers and vehicles in the event of an accident. Licenses and permits may also be required in order to operate a trucking company, and these can add to the company’s operating expenses.

Driver pay is typically the largest expense for a trucking company, as drivers must be paid for their time on the road. Operating expenses can vary greatly from one trucking company to another, so it is important to research the operating expenses of a company before deciding to work with them. Operating expenses are just one of many factors that can impact the profitability of a trucking company. Other factors, such as load size and freight rates, can also have a significant impact on a company’s bottom line.

Plus – very few trucking companies get paid up front. You have to deliver the load, and then invoice your customer. This is the basic cash flow problem for trucking companies – lots of money going out of your bank account (or on to your credit cards) to cover the cost of operating a trucking business, and no money coming in until your customer pays their invoices which can be anywhere from thirty days to six months.

But you are not alone. Most businesses experience similar cash flow struggles. Any time you have money going out immediately to cover the cost of performing your work but don’t get paid until later, you are going to have a cash flow issue. So let’s talk a little bit more about cash flow in general. It will help you understand the problem clearly, and it will also make you a better businessperson.

People in business often talk about cash flow, but few of them truly understand what it means. Cash flow is the term used to describe the “flow of cash” into your bank account versus the “flow of cash” out of your bank account. So, when people talk about cash flow, all they are talking about is “money flowing in and money flowing out.”

When your money is flowing out quickly and flowing in slowly, you tend to have “cash flow problems.” Why? Because the money is “flowing out” faster than it is “flowing in” and if this continues to happen long enough you will run out of cash to pay your bills. When you can’t pay your bills, you are out of the game. It doesn’t matter if you have a large sum of money guaranteed to you some time in the future; when you don’t have any of it in the bank, you can’t pay for fuel or make payroll– they want their money now and you can’t pay them. This is the basic cash flow problem – money flowing out faster than it flow in, or at irregular intervals.

What is Cash Flow Management?

Cash flow management is any activity used to regulate these two flows of cash (cash flowing in versus cash flowing out). The goal of cash flow management activities is to keep the money flowing into the account faster than it leaves.

When most people think about cash flow management, they tend to imagine cost cutting – reducing spending and keep costs down. But the truth is, most serious businesses do not focus a lot on cost cutting. Instead, they tend to focus on keeping cash coming in frequently and as quickly as they can get it. They may do this by borrowing money, selling bonds, selling stock (equity), factoring the money they are owed (selling it early as a discount), and trying to drive up revenues through sales activity.

Very few people are going to “reduce” their way to success. You need coming in frequently, whether that is from sales, or from taking out loans. Either way, you must have enough cash available to you to pay your regular monthly expenses or you are out of business.

What Causes Cash Flow Problems for Trucking Businesses?

Cash flow problems for Trucking Businesses are caused by the “timing” of when they get paid (money flowing into their bank account) versus the timing of when that money gets spent (money flowing out of the bank account).

Understanding the Timing Problem

When you get an order for a load, you first have to have a truck and driver ready to go, fuel up, get the load onboard, deliver it to its destination, invoice the customer, and then wait to get paid. This is the cause of the “timing problem.” It doesn’t matter that you have money coming in “soon,” you still have to pay bills, make payroll, pay for fuel, etc. So, you have money going out constantly, but you only have money coming in “occasionally.”

Because you get paid slowly by your customers, but you spend your money at regular intervals on bills and operating expenses, you have a situation where the “timing” of money coming do not match the “timing” of money going out, which creates cash flow problems.

This isn’t a problem that is unique to the freight industry; most businesses have this kind of cash flow challenge. Lawyers who work on a contingency fee basis may work for years on a case, incurring massive expenses along the way, conclude the case, and then have to wait for the defendant to pay them. Hospitals have to provide services first and bill for those services later. They often have to wait over sixty days to receive cash for services they performed. Just about every type of business has cash flow struggles created by money going out constantly, and money coming in occasionally. Freight haulers are no different.

To solve their cash flow challenges, trucking businesses need to find ways to “finance the gap” between the customer ordering a load delivered and paying for it. One way to do that is to factor your invoices with a factoring company instead of waiting for your customer to pay their bills.

It is important to understand that you can’t do anything with “money you are owed.” You have to convert invoices to cash to make use of it. In fact, this is the main reason businesses close – not because of profit or losses, but because they run out of cash to pay bills, buy fuel, and pay their drivers. As long as you have cash to pay bills and drivers, you stay in the game, but as soon as you can’t pay people, your business is going to close.

Think about it – businesses like Uber and Amazon.com do not have cash flow problems. Cash flows into those businesses every minute of every day from around the world. They always have massive amounts of cash on hand to grow, hire, and expand. Neither of these companies has great profits – in fact Uber has not turned a profit yet, and Amazon didn’t turn a profit for twenty years. But they are still in business. Why? Because of the cash flowing into their businesses every single day. But most businesses are not like that. For most businesses they are laying out cash non stop to pay for operations, to make products, to pay employees, but they have to wait for their money for thirty, sixty, ninety days (and sometimes more). So remember – cash flow is EVERYTHING to a business.

In fact, if you read about some of the largest trucking company bankruptcies in history, you will see that they ran out of money to pay bills and pay for payroll and shut down:

Financing “the gap” to Solve the Cash Flow Problem For Freight Companies

Financing “The Gap” using Credit Cards

Many truckers try to finance their cash flow with credit cards. This is particularly true of newer owner operators and small trucking businesses. Basically, they are putting all of their expenses on high interest credit cards to finance operations until their customers pay their invoices. Then, once they get paid they (hopefully) pay down their credit cards. This isn’t unusual, even to this day. In fact, prior to the existence of factoring companies, credit cards were one of the main ways truckers financed their cash flow problems.

There are some challenges with this approach. The main one is, credit cards can limit the growth of your business by simply not granting you enough credit. Because of this you’ll have to skip some opportunities until you either get a credit increase or get those cards paid down with your next load. This will forever limit your growth.

- Credit Score – credit cards are dependent upon your credit score. And the higher your balance is on your current credit cards, the less likely you are to get a credit increase or qualify for an additional credit card.

- Interest Rates – Interest rates are incredibly high on credit cards, eroding your long term buying power.

- Closed Account – most people who are new to credit cards don’t know this, but credit card companies change their lending standards regularly without telling people. And when this happens, as soon as you pay off a credit card, they close your account. That’s right. One day you pay off your credit card just like you always do, and they simply close the account (without telling you). This happens every day. This has a two-fold impact. One, you lose access to that credit line for funding operations. Two, it throws off your debt to equity ratio, and almost always causes your credit score to decline, limiting your ability to get a new credit card, or if you can get a new card, it increases your interest rate, and possibly annual fees.

So financing your entire freight business operation only on credit cards can have some issues. We aren’t saying you shouldn’t have business credit cards. In fact, you should use every financing option available to you. Just know the strengths and weaknesses of each financing option so you can make the best choices for your business.

Using Business Lines of Credit and Business Loans for Cash Flow Management

A line of credit is basically an “open” or “revolving” loan from a bank of financial institution that allows you access to cash when you need it. Unfortunately, as a trucking company, you may find that trying to secure a business loan or a line of credit is not that easy to do; especially during your early years. Banks often require applicants to present non-liquid assets, such as bonds, stocks, and real estate as collateral to guarantee they get their money back. If you don’t pay, they can at least sell your assets to offset their losses.

If you perform a search on the internet for “business line of credit for truckers” you might notice that banks do not show up on the first page of Google. No financial institution shows up at all on the first page of search results. Most of what you see are articles about how hard it is to get a business line of credit or, advertisements for private equity firms offering capital loans. This tells us that banking institutions may not be that interested in marketing a business line of credit truckers as an important part of their business strategy. If they did, those banks would show up on the first page of search results, but they don’t. In fact, you won’t find traditional banks listed hardly anywhere on the internet if you are looking for a business line of credit as a trucker.

Does this mean you cannot receive a line of credit from a traditional lending institution? Not at all. Over time as your business grows, establishes a history of revenues, develops a strong balance sheet, and has assets to use for collateral, you will find it easier to obtain financing (including a business line of credit) from banks and other lending institutions. But until then, it is not going to be easy to get a line of credit.

Why Use Factoring for Trucking Companies Instead of a Line of Credit?

- A line of credit is fantastic for many enterprises. However, there are a few benefits to factoring that make it preferable for trucking firms over a line of credit:A line of credit is difficult to obtain, especially for smaller or new trucking companies.

- A line of credit can put a ceiling on how much you’re able to spend. If your business surges, it may be hard to increase that limit quickly enough to cover the new expenses. With factoring, there is no set limit—you can factor as much or little money as you need at any given time. And if your receivables are healthy, you could qualify for up to 99% of each invoice’s value. qualifying for

- When you have a line of credit, your debt-to-equity ratio lowers, making it harder to be approved for loans in the future. This is because when lenders see that you already have borrowed money, they become less likely to give you more. Factoring doesn’t appear on your credit report like taking out a loan would, so using this method won’t impact your chance of borrowing again later down the road; giving leeway to use funds for other business expenses such as truck repairs or office expansion.

- Lenders are constantly changing their lending standards, which can result in your business credit card or line of credit being closed without notice. This is especially true for credit card companies, who often close accounts when the balance is low or zeroed out without any warning. One day you may have a line of credit, and the next day you may not. But with factoring, you aren’t applying for credit, and there is no account to “close.” As long as you have invoices owed to you, you can factor part of them to manage your cash flow.

- Interest and fees for business credit cards are commonly high, as are those for lines of credit. In contrast, rates truckers get charged for factoring are typically lower than the interest rates of credit cards or lines of credit.

Factoring Can Help Trucking Companies Take on New Clients

Factoring can help trucking companies take on new clients. When a trucking company takes on a new client, there are often a lot of expenses involved. If the trucking company does not have the cash to do this, it may be unable to take on the new client. However, if the trucking company has access to factoring, it can use this funding to cover the upfront costs and take on new clients without any financial difficulty.

This is true for a lot of businesses. Because taking on a new client often creates a lot of new expenses, some businesses avoid opportunities that come along because they know they can’t afford the additional expense a new customer is going to bring. This is particularly true of larger customers who are used to stretching out their vendors to sixty or ninety days before they pay their invoices. Being slow to pay is not an uncommon practice for large corporations. It’s as if they feel that doing business with them is a privilege and so you shouldn’t be surprised that you have to wait longer to get paid by them. For a lot of trucking businesses, slow payers can feel like death by a thousand cuts.

But if you have access to capital through a factoring company, you can afford to take on new clients as well as bigger clients because factoring will help you get some of your cash in the bank right away so you can continue growing with confidence, knowing a large new client isn’t going to bankrupt you while you wait on them to pay their invoices.

Factoring Can Help Trucking Businesses Grow

Factoring can also help trucking companies grow their business. When a trucking company is able to keep its trucks running and take on new clients, it can start to expand its operations. This growth can lead to more revenue and more profit for the trucking company. Factoring can help trucking companies achieve this growth by providing them with the funding they need to keep their business running smoothly.

You’ve probably heard the phrase “opportunity waits for no one.” This is true. You need to be prepared if you want to capitalize on new opportunities. Being prepared might mean having more trucks and drivers than you currently have business. It might mean keeping plenty of cash on hand to enable you to fund new business opportunities as they come up. But if you are always short on cash because you are constantly waiting on your customers to pay you, it makes it challenging to take on any new opportunity. After all, you can’t make truck payments or payroll with “money you are owed.”

Because of this, many small trucking companies tend to stay small. They are afraid of new customers and particularly of big customers because they know they can’t afford to service these types of clients because they are always tight on cash, and each new load creates new expenses. But if you factor your freight invoices, you can get money in the bank quickly. The factoring company gets paid to “do the waiting” for you, and you get to keep growing and expanding.

Business owners who think small tend to stay small. Large companies never hesitate to finance their future operations using “other people’s money.” They sell stock, bonds, take on debt, solicit private equity investors, and take out loans to finance their growth. No large business attempts to finance their future growth with their own limited cash reserves. They “leverage” the power of other people’s money to help catapult them forward. So if big business does this, why wouldn’t you?

Trucking Factoring Companies

Trucking Factoring Companies are also known as Freight Factoring Companies and simply Factoring Companies. A Freight Factoring Company or Trucking Factoring Company is in the business of helping companies in the trucking industry and other freight companies to manage their cash flow, growth their freight company, and in general aid with having consistent cash flow by factoring their invoices.

The best freight factoring companies and factoring companies in general will be well established, understand freight factoring, offer a competitive factoring fee, be easy to work with, have reasonable factoring agreement, have experience as a factoring company helping the trucking industry.

About Factoring Companies

Factoring Companies are specialty finance companies who purchase invoices from truckers at a discounted rate, pay the trucking company now, and get paid themselves when the customer pays their invoices. The best factoring companies will know about trucking companies, how their operations work, understand a freight invoice, and be able to work with large trucking companies as well as owner operators to help them manage their operations where bank financing may not be the best or easiest option for them to use. This is especially true for smaller companies or owner operators. Some Factoring companies may offer incentives like same day invoice processing, or low monthly invoice volume, or low monthly minimums.

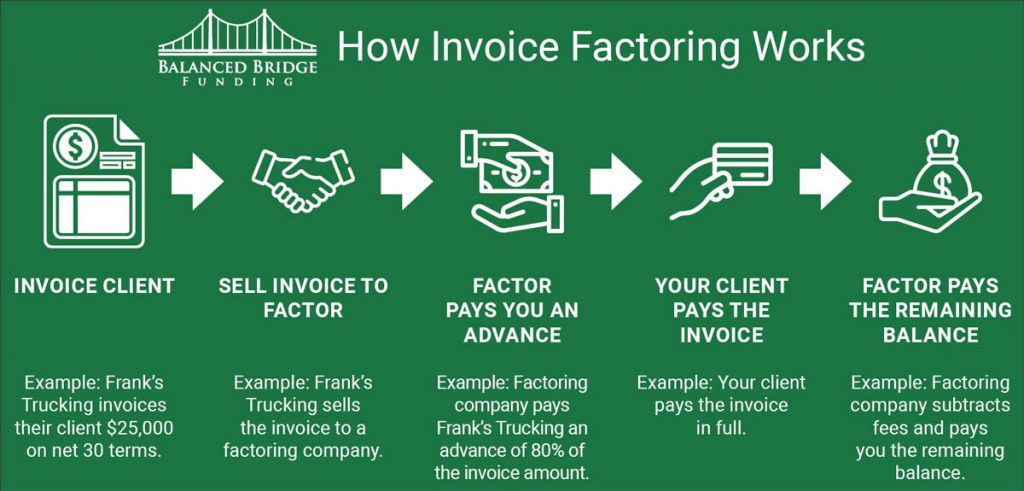

What Does a Freight Factoring Company Do?

It is important to know the basic service that a factoring company offers to truckers. A factoring company will purchase your freight invoices for a fee, and then they will provide you with funding based on those invoices. The funding you receive can be used to cover operating expenses, driver pay, or any other expenses associated with running your trucking business. Once the customer pays the invoice, the factoring company will remit the balance of the invoice to you, minus their fee.

Here is How A Factoring Company Works

- A customer hires you to ship freight from one location to another.

- You do a credit check with your factoring company to see if the customer’s load qualifies.

- Once you complete delivery, you send the invoice and paperwork to the factoring company.

- They purchase that invoice, and your company receives cash right away.

- The factoring company then collects the payment from the customer.

Recourse vs Non-Recourse Factoring

When considering using a factoring company, you’ll come across the terms ‘recourse’ and ‘non-recourse’. It’s important to understand the difference between the two, as it will affect how much money you get per invoice. Here’s a quick overview:

Recourse Factoring: Though companies that offer recourse factoring take a smaller percentage, if they are unable to collect payment from your customer, you have to buy back the invoice.

Non-Recourse Factoring: Compared to the alternative, non-recourse which means you won’t be held responsible for paying the invoice if the client doesn’t pay. However, with non-recourse factoring, the factor company takes a far bigger proportion of the invoice amount. This makes sense though – more risk on their part means more reward for the factoring company.

Summary – Factoring for Trucking Companies

Factoring for trucking companies is a great way to ensure positive cash flow. But what exactly is factoring, and how does it work?

In short, factoring is when a trucking company sells its invoices to a third-party company—the ‘factor’—in exchange for quick payment, usually within 24 hours. The factor then collects payment from the trucking company’s customers.

There are two types of factoring: recourse and non-recourse. With recourse factoring, if the factor is unable to collect payment from the customer, the trucking company is responsible for paying back the invoice. Non-recourse factoring means that the trucking company is not liable if the factor is unable to collect.

Factoring is a great option for trucking companies because it is easy to obtain and there is often no set limit on how much you can factor. Additionally, using factoring will not impact your chance of borrowing again in the future like taking out a loan would. And finally, rates for factoring are typically lower than the interest rates of credit cards or lines of credit.

If you’re a trucking company owner looking for a way to improve your cash flow, look into factoring! It just might be the solution you’ve been searching for.

About Factoring for Trucking Companies with Balanced Bridge Funding

Does Balanced Bridge Funding Offer Recourse and Non-Recourse Factoring?

Balanced Bridge Funding does not offer non-recourse factoring for trucking companies. We only offer Recourse Factoring for Trucking Companies.

How to Begin Factoring for Trucking Companies

To get started using our factoring for trucking products, we will need to receive a copy of your application, business formation documents, proof of operating authority and insurance owner’s driver’s license. Once we receive these documents and you pass a clean public background search, we are able to factor trucking companies’ receivables for you.

Ongoing Factoring for Trucking Companies

Once you have worked with us on your first advance, things become even easier (and faster) for you. For each request for trucking factoring, we will need to all relevant documents for the completed job, this can include, rate confirmation sheet, invoice, dump tickets, etc.

Fast Approval for Factoring for Truckers

Approval of each request occurs in hours and the funds will be wired directly into the account via ACH or wire transfer (for an additional fee).

What Percentage of an Invoice will Balanced Bridge Factor for Trucking Companies?

We will purchase up to 99% of the value of the invoice.

How Does Balanced Bridge Handle Repayment of Factoring for Truckers?

For repayment, we can either submit the invoice ourselves for payment or you can remain the main contact and then we will automatically pull the repayment amount directly from your account when the invoice has been paid.

Quick Summary of Steps to begin Factoring for Trucking Companies with Balanced Bridge Funding

- Submit application and entity documents to get company approval – usually completed within 1-2 days

- Submit supporting documents for each invoice – receive approval within hours of receipt

- Funds are wired immediately to account (if they pay the wire fee) otherwise funds will be deposited directly into account via ACH within a couple of days

- When invoice has paid, the repayment amount will be pulled directly from the account via ACH or sent directly to us

Balanced Bridge Funding – Trucking Factoring Rates

We do not publish our Trucking Factoring Rates online and we hope you will understand. The market changes dynamically in the transportation industry, and our rates change with it. But you can rest assured that Balanced Bridge Funding is always competitive and offers great rates for your Trucking Factoring. Contact Us Today to Complete Your Application. Receive your funds quickly and efficiently.

Give us a call at 267-457-4540 or Click Here to Apply Today!