By providing the confidence of solid financial backing to law firms and plaintiffs involved in litigation

Introduction

Legal Funding has leveled the litigation playing field. Until recently, large cases were simply too expensive for smaller firms to even consider taking on. The cost of litigating large cases can run into millions of dollars and takes years to conclude. Plus, once a defendant settles or a judgment is awarded, it can take years to receive the money from a defendant.

Without financial backing, small and mid-sized law firms could not endure the lifecycle of larger cases. Imagine having to pay rent, salaries, benefits, technology costs, legal subscription fees, and all the other expenses that factor into running a law firm – and having to do that for YEARS without getting paid. How would your law firm survive it?

And that would just you’re the cost of covering your bills. That doesn’t include the cost of taking on a case, travel, discovery, hiring the best witnesses, hiring contract lawyers, courtroom graphics specialists, and litigation support staff to make sure you win the case.

Because of the time it takes to reach a settlement and the additional waiting lawyers must do to get their money from a defendant, most small and mid-sized firms simply lack the funding to take on these types of cases – so they didn’t.

But in recent years, Legal Funding Companies have taken a prominent role in litigation by offering financial backing for lawsuits in exchange for a percentage of the winnings (assuming the law firm wins the case). With strong financial backing from Legal Funding Companies, small and mid-size law firms receive the financial strength they need to endure long waits, hire the best experts, present the best possible case, and win big for their clients.

Larger law firms are also working with Legal Funding Companies. By working with a financier who only gets paid at the end of cases, large law firms get access to financial leverage without having it degrade their balance sheets (like taking on debt does) because there is no debt against the money until a case concludes and never hits the balance sheet as a liability.

Legal Funding has gained in popularity over the last five years (as of 2023) and is expected to continue growing as an industry. As law firms learn more about how other firms are using litigation financing to help win bigger settlements (which creates larger contingency fee payouts) and keep their balance sheets clear of long-term debt, more law firms are willing to engage with and make use of litigation funding options.

What is Legal Funding?

Legal funding is a financial arrangement where a finance company, which has no direct involvement with a lawsuit, takes a financial stake in the outcome of a case for a percentage of the winnings or settlement once a case concludes – or – where a law firm or plaintiff has already achieved a settlement or judgment and sells a portion of the pending funds to a Legal Funding Company (at a discounted rate) to get some of their money right away.

Are There Different Types of Legal Funding?

Yes, there are. Though there are lots of legal funding options out there, the primary litigation finance options fall into either pre-settlement funding or post-settlement funding.

What is Pre-Settlement Funding?

Pre-settlement funding is when a Legal Funding Company provides financial backing for a lawsuit before the case has concluded in exchange for a portion of any settlement or award.

Why do Law Firms Use Pre-Settlement Funding

- Law firms use pre-settlement funding to finance taking on larger cases so they can endure the financial impact litigation has on cashflows when cases drag on for long periods of time as they wind their way through the court system.

- Lawyers use pre-settlement funding to hire the best experts and witnesses to help them win their cases.

- Attorneys use pre-settlement funding to endure the “stall tactics” many defense lawyers will use to try and wear down attorneys and plaintiffs, hoping they might take a smaller settlement just to “get it over with.”

Why Do Plaintiffs Use Pre-Settlement Funding?

- Plaintiffs use pre-settlement funding to help offset the costs/impacts of injuries they have sustained related to their case. This may include lost work, medical bills, disability, re-training for a new profession (if they can no longer work at their old job), physical therapy, mental health therapy, and more.

- Plaintiffs can take advantage of pre-settlement funding to help them endure the stall tactics defense attorneys use to try and wear down a plaintiff, hoping they accept a smaller settlement.

- Sometimes Plaintiffs use pre-settlement funding because their lawyer is sure they are going to win and the plaintiff wants some of their money now rather than waiting years to see any of it. Going through a lengthy court battle is mentally and emotionally taxing – why shouldn’t a plaintiff want access to some of their money right away?

What is Post-Settlement Funding?

Post-Settlement funding is when a case has been settled or a judgment has been awarded and the law firm or the plaintiff sells a portion of their settlement or award to a Legal Funding Company at a discounted rate so they can get some of their money right away.

Why do Law Firms Use Post-Settlement Funding

- Law firms use post settlement funding to help get money back in their bank account to help manage cash flow. The law firm might have spent years working to win a settlement or judgment on behalf of their client – and often they must wait months or sometimes years to receive the funds from the defendant. Post settlement funding allows them to get some of their money right away and the rest later.

- Lost time is lost opportunity – there is an opportunity cost associated with waiting on anything, including money. By getting access to the contingency fees they are owed, law firms can hire new talent, search for more cases, increase their marketing, and more.

- Sometimes the lawyers just want to get some of their money as soon as possible. After all, they’ve probably endured years of fighting in court on behalf of their client, and now that the case is over, why wouldn’t they want to get some of their money in the bank?

Why Do Plaintiffs Use Post-Settlement Funding?

- They’ve waited long enough! One thing most people don’t understand is that when you win a settlement or a judgment, there isn’t someone waiting in the lobby waiting to write you a check. It can take months, years, or even decades for a defendant to pay what they owe. Post-settlement funding allows plaintiffs to get at least some of their money right away (for a fee).

- They have expenses – If you’ve been injured by a defendant, chances are that injury has costs associated with it. This may come in the form of medical bills, retraining, physical therapy, psychotherapy, relocation, and more. Your whole life may have been turned upside down by your injury, and getting your money quickly can help you move on from the event.

How Long Does it Take to Get Paid From a Lawsuit?

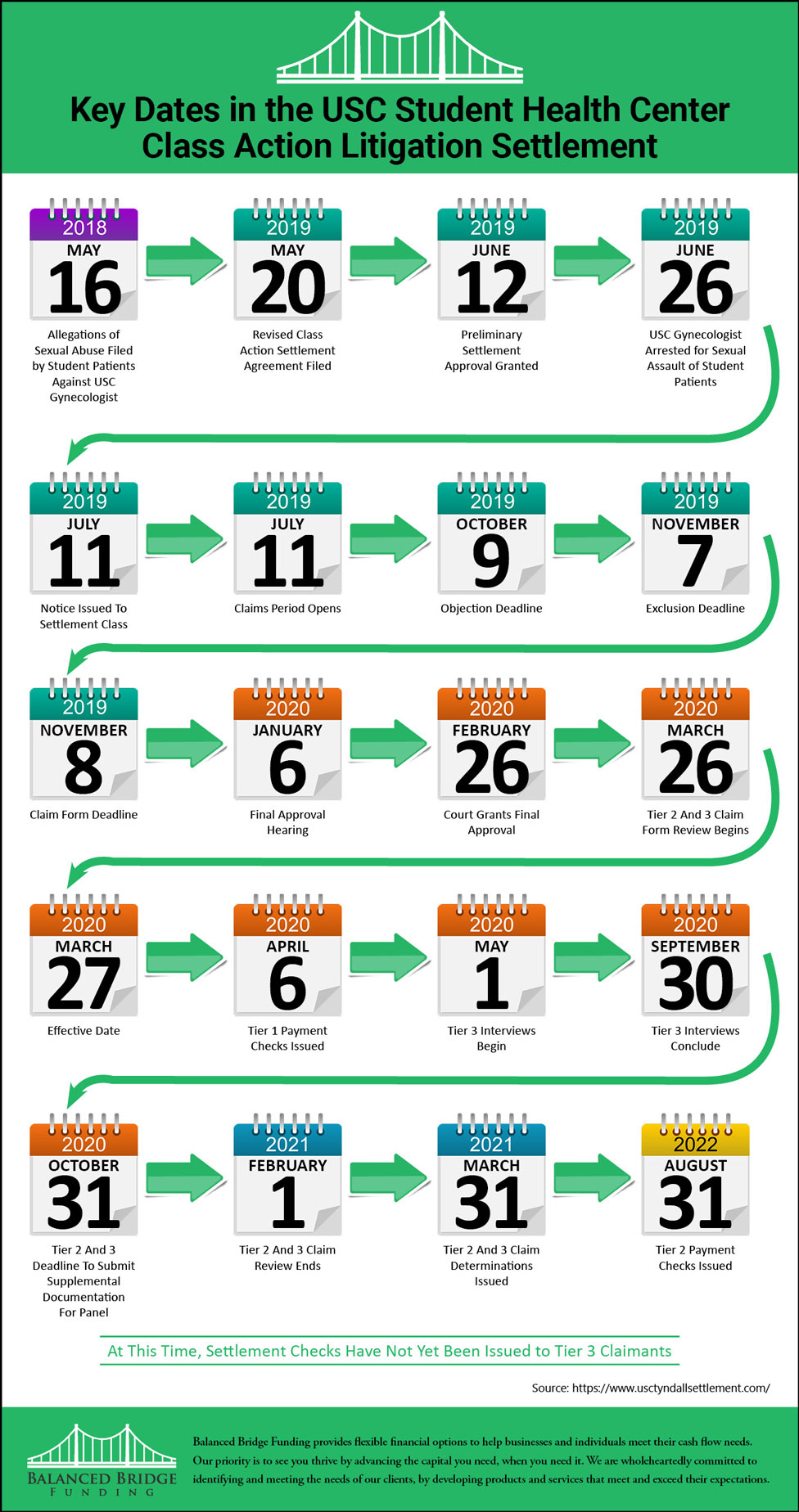

There is no short way to answer this question. Once a case settles there are many factors that go into determining when a defendant has to pay what they owe. In some cases, a plaintiff might receive their funds in one month. In larger settlements or class action settlements, it can take years before the defendant pays.

Example: In the recent JUUL E-Cigarette maker class action lawsuit, JUUL was given the option of paying the settlement (almost $300 Million) over a period of ten years. Read more about the JUUL E-Cigarette maker class action suit.

Example: When USC settled its sexual assault class action lawsuit, USC was allowed to pay plaintiffs over the course of almost eighteen months, in spite of the fact that they had ample ability to pay at any time. Read more about the USC class action lawsuit settlement.

Read more about the USC class action lawsuit settlement.

So you see, it can take a long time to get paid from a settlement award or judgment once a lawsuit concludes.

If you’d like to learn more about how long it takes to get paid from a big case like a class action lawsuit settlement, read our article about how long it takes to get a check.

Why People and Companies Don’t Pursue Litigation?

Did you know that a major reason individuals and businesses don’t pursue litigation is because of the expense?

Litigating a case is expensive. For attorneys costs might include travel, expert witnesses, litigation support, detectives, and more.

For individuals, even if their lawyer takes their case on a contingency fee basis (doesn’t get paid unless and until they win) there are still expenses in the form of missed work, daycare, and more. Lots of people live paycheck to paycheck and can’t afford to miss work.

Even large businesses that have an in-house legal team, often don’t pursue litigation because of the cost, even though a win could bring in a lot of capital into the business. In a recent survey, 49% of senior financial officers said they failed to pursue litigation in 2020 because of cost, even though half of those cases could have yielded over $20 Million

Source: https://www.burfordcapital.com/media/2200/burford-2021-legal-asset-report.pdf

This is one of the reasons legal funding is helping to level the litigation playing field – because individuals, businesses, and law firms can get the financial backing they need to take on cases, and endure the length of the case as it winds its way through the court system, and get some of their money while they wait on a defendant to pay.

Better Access to Justice

In a recent survey, 88% of lawyers who participated said they believe legal funding enables better access to justice.

Source: Bloomberg Law’s 2023 State of the Legal Funding Industry Report

But what does “better access to justice” mean?

Endurance for The Long Haul: We can tell you from our experience in the legal funding industry that one of the tactics employed by defense attorneys is to stall cases for as long as they can. If law firms or clients are short on money or patience, they might agree to a settlement just to “get it over with” because they needed the money. But with legal funding, both plaintiffs and law firms have been better able to endure these long waits (by getting some of their money up front), and lawyers have been able to win a larger settlement for their clients.

Confidence of Being Well Financed: As we mentioned earlier in this post, one of the main reasons individuals and businesses don’t approach litigation is because of the costs associated with it. Even though plaintiff attorneys work on contingency fees, there are opportunity costs for the plaintiff including missed work, travel for depositions, and other expenses an individual might have to deal with.

Businesses with in-house counsel often forgo legal action because of the cost of taking on and winning the case, because it can deplete their cash.

But with legal financing providing the backing, individuals, and businesses can approach litigation with confidence, knowing they have the cash available to cover whatever expenses come up and continue living their lifestyle or running their business respectively.

How Does Post Settlement Funding Work?

How Post Settlement Funding Works – Once you (the law firm or plaintiff) have reached a settlement or judgment, the money you are owed is considered an asset. You own the rights to the money you are owed. Because it is an asset, all or part of it can be sold.

We (Balanced Bridge Funding) purchase a portion of the amount owed to you (at a discount). You get money now, and we own the asset (a portion of the settlement funds you sold to us). You go on about running your law firm (or living your life), and we wait for the settlement funds to be paid to us directly by lead counsel, or whoever is designated to distribute the funds on behalf of the settlement.

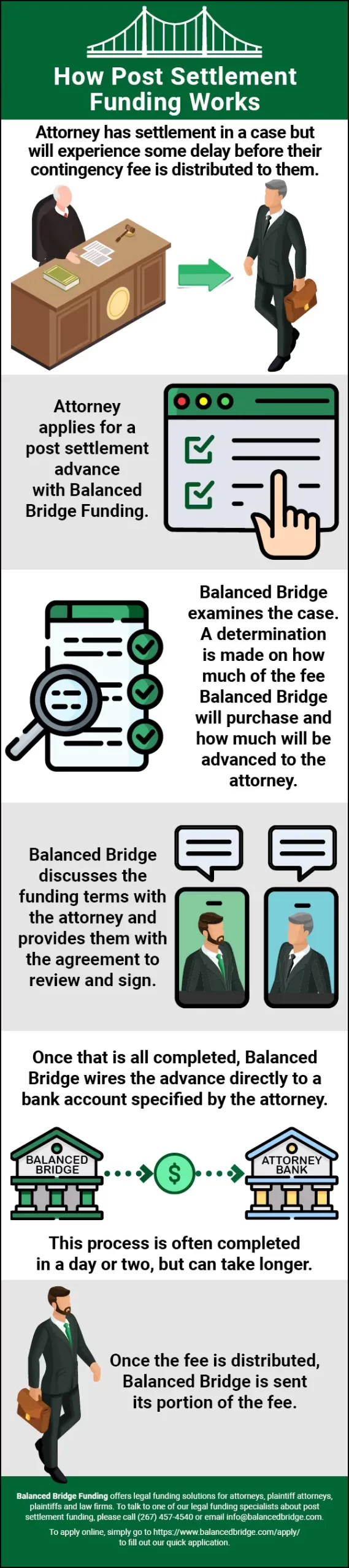

How Post Settlement Funding Works Infographic

Let Us Explain How Post Settlement Funding Works

• Attorney has settlement in a case but will experience some delay before their contingency fee is distributed to them

• Attorney applies for a post-settlement advance with Balanced Bridge Funding.

• Balanced Bridge examines the case. A determination is made on how much of the fee Balanced Bridge will purchase and how much will be advanced to the attorney

• Balanced Bridge discusses the funding terms with the attorney and provides them with the agreement to review and sign.

• Once that is all completed, Balanced Bridge wires the advance directly to a bank account specified by the attorney.

This process is often completed in a day or two but can take longer.

Once the fee is distributed, Balanced Bridge is sent its portion of the fee.

Is Post Settlement Funding a Loan?

Post Settlement Funding is NOT a Loan.

Although Post Settlement Funding is often referred to as a loan for lawyers, or settlement advances for lawyers, it is not a loan. If you look at the infographic above or the explanation below it, you will see that the litigation finance company isn’t loaning you money against your settlement award. Instead, they are purchasing it from you and then they get their money from the attorney of record handling the distribution of funds from the case.

Summary – How Legal Funding is Leveling the Litigation Playing Field

Prior to legal funding being available, large cases were accessible only by the largest of law firms because of the cost of taking on a case and the time it takes to settle or win. Cases can take years to make their way through the court system, during which time, the firm still had to cover their rent, salaries, overhead, plus the cost of the case itself. Because of this, smaller law firms simply did not have the financial strength to take on larger cases, even if they wanted to.

But with Legal Funding Companies providing financial backing, firms of all sizes can take on larger cases, hire better experts and witnesses, and endure the stall tactics often employed by defense attorneys to broker a lower settlement.

There are two primary types of Legal Funding: Pre-settlement Funding and Post Settlement Funding.

Pre-settlement funding is financing for a case that has not yet concluded. Pre-settlement funding is available for both plaintiffs and attorneys and can be used to finance winning the court case (for attorneys) or finance medical bills, physical therapy, psychotherapy, travel, and more (for plaintiffs).

Post-Settlement funding is funding for attorneys and plaintiffs available AFTER a case has concluded. In Post settlement funding, a Legal Funding Company purchases a portion of the settlement award at a discounted rate. The plaintiff or attorney gets some of their money right away, and the legal funding company receives what they are owed directly from the Attorney of Record handling the payouts.

Legal funding is helping to level the litigation playing field and is gaining a much wider acceptance among lawyers. Legal Funding was once primarily used by small and mid-sized law firms, but as of 2023, even large law firms are taking advantage of legal funding because it helps finance their growth, and keeps costs of ongoing litigation off of their balance sheets, providing additional value to their shareholders (or stakeholders as the case may be).

Because of this, the Legal Funding Industry is growing, and we can expect to see it continue to grow as more and more law firms learn about legal financing strategies that have helped their contemporaries grow and succeed.

About Legal Funding with Balanced Bridge Funding

Does Balanced Bridge Funding Offer Pre-Settlement Lawsuit Funding?

Balanced Bridge Funding does not offer pre-settlement funding at this time. We do offer post-settlement funding options for attorneys as well as plaintiffs whose potential settlements qualify (which many do).

A Post Settlement Advance is a Non-Recourse Transaction: We Accept All the Risk

Post Settlement funding is a non-recourse transaction. This means you don’t need to worry about what might happen if the defendant suddenly can’t pay your settlement award — we accept all risk of non-payment, meaning that you will still get to keep the money from your settlement advance if the defendant goes bankrupt or is unable to pay for whatever reason.

Fast, Hassle-Free Application

In most cases, we can get money in your hands in one week or less. Our application is simple, straightforward, and easy to complete. Remember, this isn’t a loan, so there isn’t as much paperwork to go through. In most cases, we can approve your application and have your money deposited into your checking account in a matter of days.

About The Authors

Balanced Bridge Funding offers legal funding solutions for plaintiffs, plaintiff attorneys, attorneys, and law firms. To talk to one of our legal funding specialists about getting help managing your law firm cash flow, please call (267) 457-4540 or email info@balancedbridge.com.

Or to apply online, simply CLICK HERE and fill out our quick application.